WIFO-Konjunkturtest

Part of the Joint Harmonised EU Programme

of Business and Consumer Surveys

WIFO-Konjunkturtest

Part of the Joint Harmonised EU Programme

of Business and Consumer Surveys

WIFO-Konjunkturampel (economic traffic light)

The results of the WIFO-Konjunkturtest (business cycle survey) for February show a slight decline in business confidence. The WIFO Business Climate Index stood at –0.7 points (seasonally adjusted), 0.3 points below January. Assessments of the current situation improved compared with the previous month (+1.7 points) and, at 0.6 points, were in positive territory for the first time since May 2023. Economic expectations, on the other hand, declined (–2.0 points) and, at –2.1 points, were back below zero. The deterioration in economic expectations is evident across all sectors, while the improvement in the index of the current business situation is mainly driven by improvements in services and manufacturing, with expectations in the construction industry continuing to decline.

Economic Sentiment and Employment Expectations Down in the EU and the Euro Area

In February 2026, the Economic Sentiment Indicator (ESI) decreased in both the EU and the euro area (–1.0 point to 98.3 points in both areas). The Employment Expectations Indicator (EEI) also declined compared to January (EU:–0.7 points to 98.5 points, euro area: –0.6 points to 97.6 points).Both indicators continue to score slight below their long-term averages of 100 points.

Credit Conditions of Austrian Companies

The credit questions of the WIFO-Konjunkturtest (business cycle survey) allow us to present the assessments and experiences of companies with regard to bank lending. The credit questions are asked quarterly in February, May, August and November.

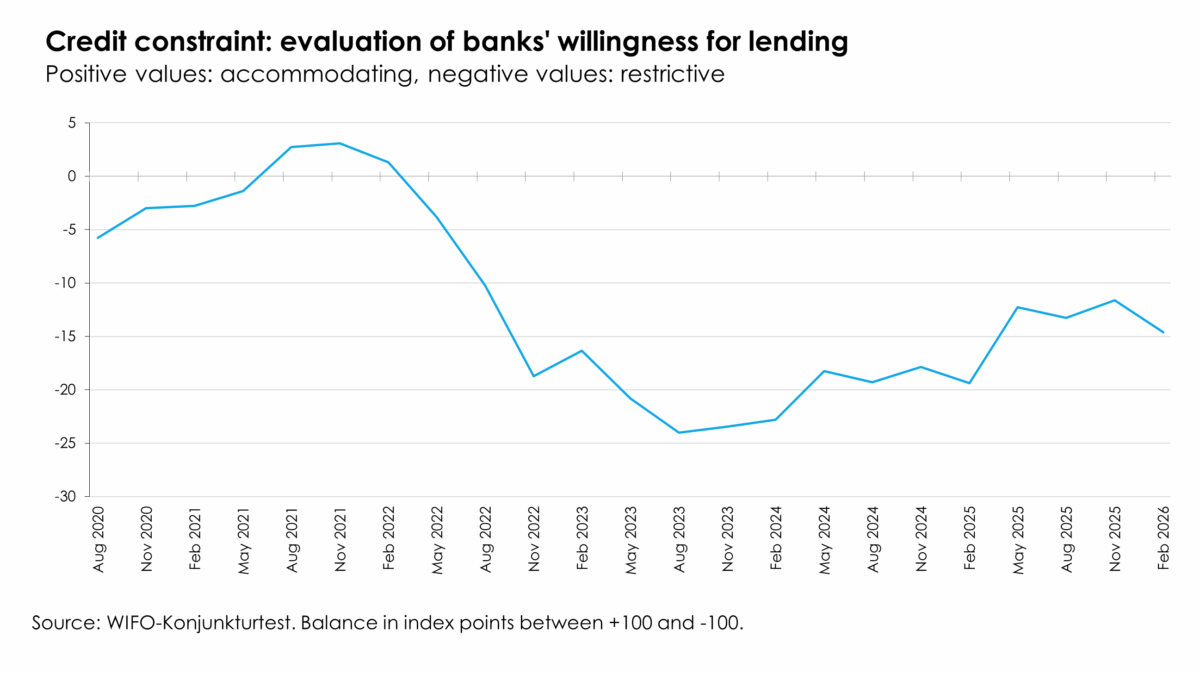

In February 2026, companies' assessments of banks' willingness to lend – defined as the balance of the proportion of companies that describe banks' lending as accommodative (positive values) and the proportion of companies that describe banks' lending as restrictive (negative values) – deteriorated compared with the previous quarter (–3.0 points) and were in negative territory at –14.6 points. There are differences depending on company size: the credit hurdle is higher for smaller companies (fewer than 50 employees) (–17.0 points) than for medium-sized companies (50 to 250 employees: –7.4 points) and large companies (more than 250 employees: –8.7 points).

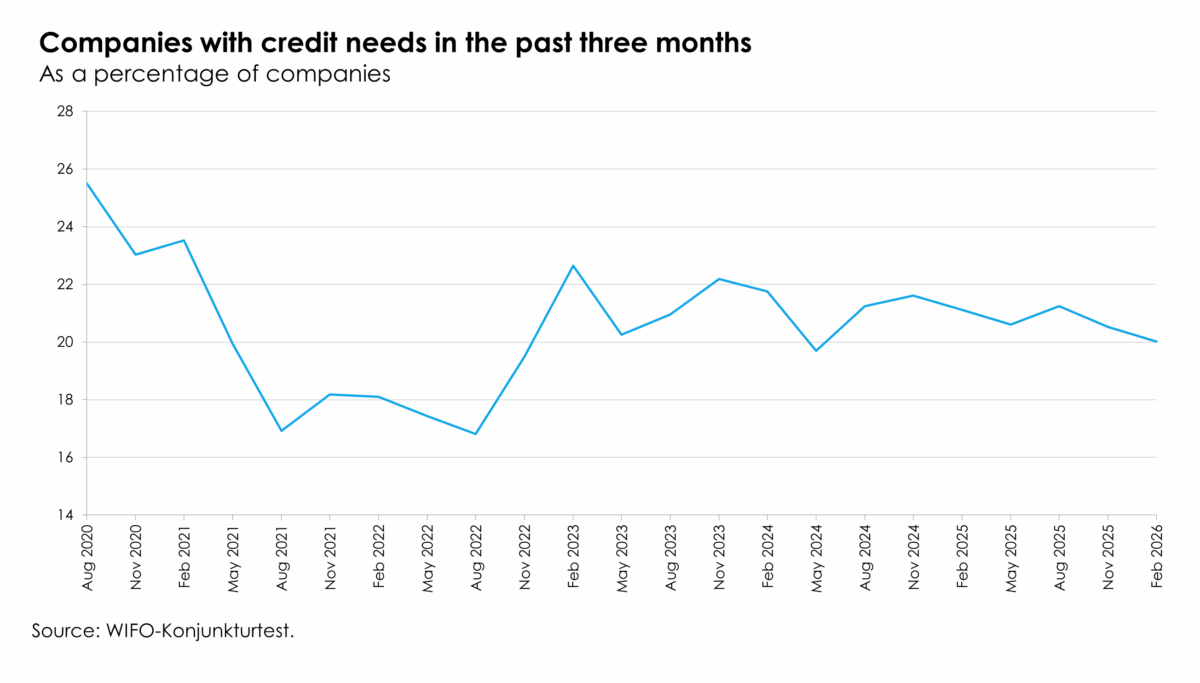

The survey results show a slight decline in credit demand (–0.5 percentage points compared with the previous quarter) with a value of 20.0% (long-term average: 20.8%) in aggregate (excluding retail). In manufacturing, credit demand remained above average (23.0% of companies reported credit demand), while in retail (20.6%) it remained stable and in the service sectors (19.0% of companies) and construction (16.8%) it was average or slightly below average. By company size (excluding retail), 19.8% of smaller companies (fewer than 50 employees) reported a need for credit, as did 21.6% of medium-sized companies (50 to 250 employees) and larger companies (more than 250 employees).

Of the companies with credit needs (excluding retail), around 36.3% had to make concessions in terms of the amount or conditions (17.1% reported worse conditions, 11.4% lower amounts and 7.8% worse conditions and lower amounts than expected). This figure is slightly above the average for the past five years (33.3%). Around 38.0% of companies requiring credit were able to obtain it as expected (5-year average: 38.7%). The proportion of companies requiring credit that did not receive credit or did not apply for it was slightly below average at 26.4% (5-year average: 28.0%; around 5.3% of all companies surveyed) was slightly below average because their loan application was rejected by the bank (4.7%), the terms were unacceptable (10.5%) or they had not attempted to obtain a loan because they had no chance of success (11.2%).

Credit Constraints and Credit Needs

Recent issues: WIFO-Konjunkturtest

Quarterly results of the WIFO-Konjunkturtests

Special issues: WIFO-Konjunkturtest

Recent issues: WIFO-Investitionsbefragung

Contact

For general enquiries, please contact konjunkturtest@wifo.ac.at.