Tariffs of the USA Hit North America Hard

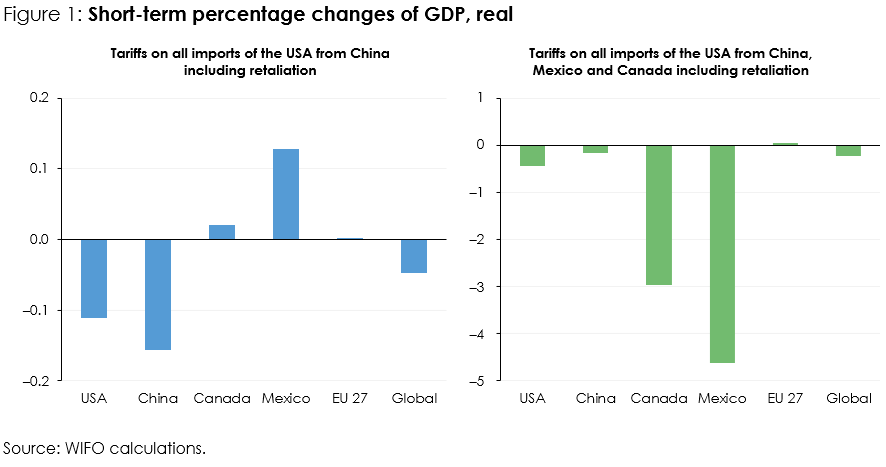

In the first stage, the USA imposed a 10 percent tariff on all imports from China, prompting Chinese retaliatory measures on 80 exported products from the USA, leading to a slight GDP decline in China (–0.16 percent) and a negative effect on the economy of the USA (–0.11 percent, approximately 35 billion $). While Canada and Mexico were initially barely affected, the second scenario reveals far more drastic consequences: the additional 25 percent tariffs of the USA on all imports from Canada and Mexico, along with retaliatory measures from these countries, which have been suspended for the next 30 days, would lead to substantial economic losses.

According to the simulations, Mexico would be hit the hardest, experiencing a –4.6 percent drop in real GDP, while Canada would also suffer significantly (–2.97 percent). The USA itself would see a considerable decline (–0.45 percent), as higher import costs make production more expensive and raise consumer prices. This corresponds to a loss of around 131 billion $ – as much as Slovakia's GDP. Global production levels would shrink by –0.24 percent, while the EU would see only minor positive effects (+0.03 percent).

"The economic consequences of this escalation are severe and could lead to long-term disruptions in North American trade relations", explains Hendrik Mahlkow, trade expert at WIFO. While China faces relatively limited economic losses, North America is at risk of significant economic damage.

With growing uncertainty for businesses and investors, it remains unclear whether negotiations will lead to new trade agreements or if the conflict will escalate further. The EU and other trading partners are closely monitoring the situation, as further protectionist measures cannot be ruled out.

Please contact