Competitive Disadvantages Slow Down Growth in the Austrian Economy

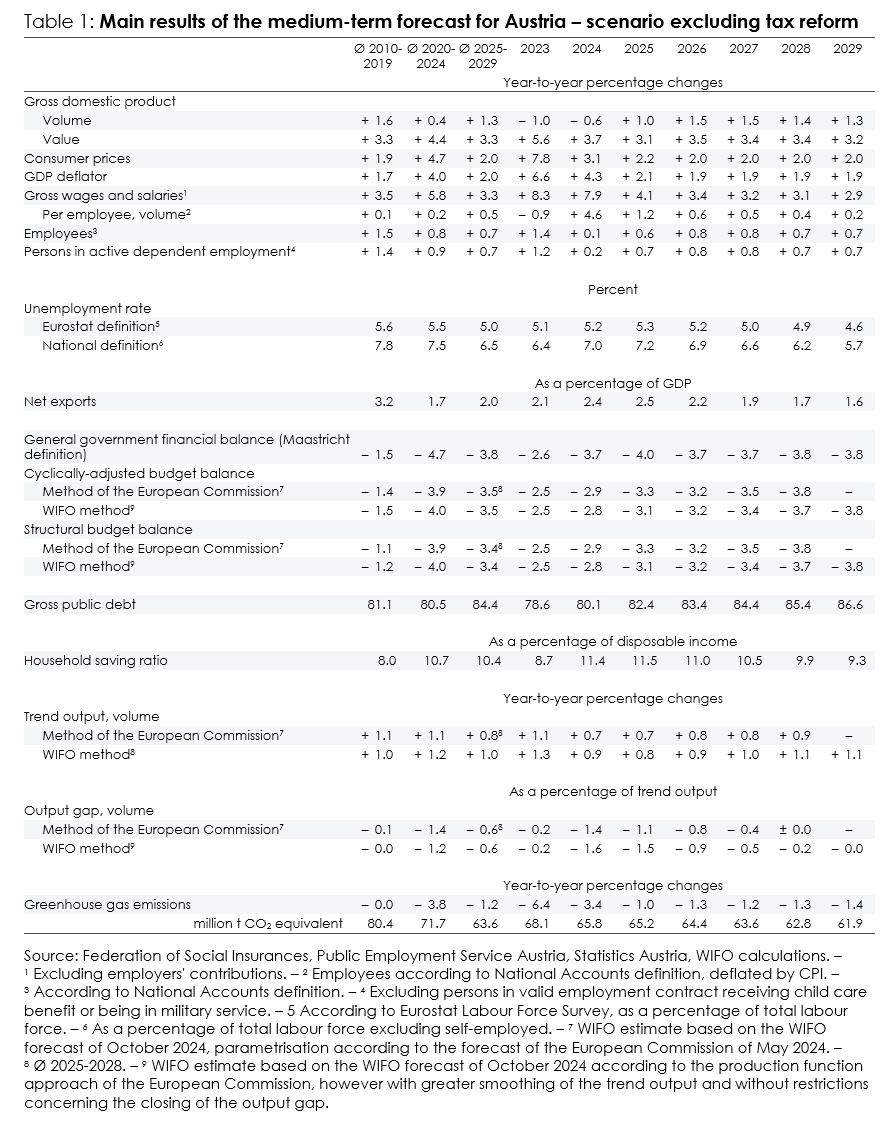

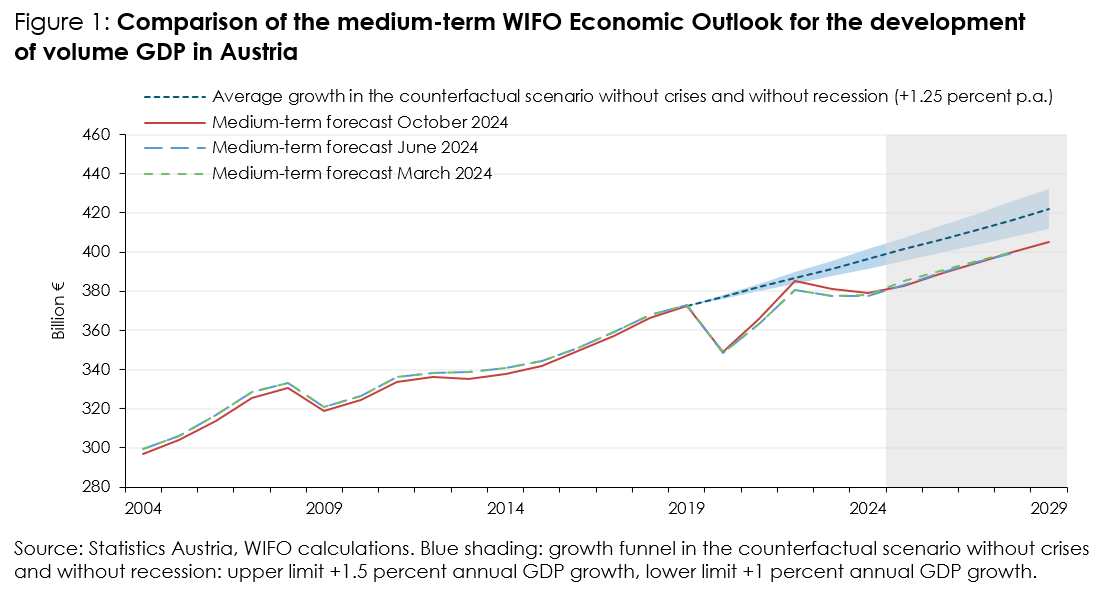

"Due to the COVID-19 crisis, the energy price crisis and the recession in 2023-24, Austria lost a significant amount of value added. Depending on the assumptions regarding average growth in a counterfactual scenario without crises and without a recession, the losses in 2020-2029 are between 105 and 215 billion €," says Josef Baumgartner, one of the authors of the WIFO medium-term forecast.

International and monetary framework

In the most important countries and country groups for the Austrian export industry (euro area, CEEC 5, USA, China, Switzerland), it is assumed that the growth of real GDP (export-weighted) will increase from ¾ percent (2023) to 2 percent (2026) and then weaken again somewhat (2029 +1¾ percent).

Following the interest rate cuts in June, September and October (each –¼ percentage points), WIFO expects further interest rate cuts in the euro area. In the medium term, the three-month interest rate is expected to fall from 3.6 percent (2024) to 2½ percent (2026). The secondary market yield for 10-year German government bonds is expected to fall from 2½ percent (2024) to 2 percent (2025-2027) and rise to around 3 percent by the end of the forecast period.

Based on the described growth and interest rate trends in the USA and the euro area, the exchange rate of the dollar against the euro will remain almost constant (2025: 1.11 $, 2029: 1.08 $ per euro).

Macroeconomic outlook for Austria

Austria's economy is only slowly recovering from the recession of 2023 (–1.0 percent) and 2024 (–0.6 percent). Compared to other European countries, energy prices and unit labour costs are higher in Austria. As a result, the energy-intensive export industry in particular will continue to be at a competitive disadvantage in the medium term. Further structural problems exist in the integration of migrants, in the labour market participation, as well as in the education system, which will also slow down the medium-term outlook for real GDP.

The Austrian economy will therefore grow by 0.2 percentage points less than the euro area average each year. According to the European Commission's method, trend growth is ¾ percent p.a. (Ø 2010-2019 +1.1 percent p.a.). For 2025-26, WIFO expects growth of real GDP of 1 percent or 1½ percent, and 1¼ percent p.a. for the entire forecast period 2025-2029 (Ø 2010-2019 +1.6 percent p.a., see Figure 1).

Private consumption is likely to pick up from 2025, increasing by an average of 1½ percent p.a. in the forecast period and thus supporting the growth of real GDP. The recovery of the global economy will also revitalise (goods) exports somewhat: in 2025-2029, exports (in the broad sense) will grow by 2½ percent p.a. (in volume terms).

Due to the international economic recovery, the decline in interest rates and the corporate tax rate, and favoured by the (eco-)investment allowance and catch-up effects, investment in machinery and equipment will grow by 4 percent in 2026. Although the switch to a CO2-lower production method requires increased investment in the energy transition, the high level of uncertainty and the rise in unit labour costs mean that industry in particular is likely to be reluctant to invest, as the difficult environment in Europe is hampering competitiveness. Growth is expected to average 2¾ percent per year in 2027-2029.

The weakening of construction activity primarily affects residential construction: due to high inflation, the purchasing power of disposable household income and the real value of savings have shrunk, while tighter lending rules and, above all, higher lending rates make it much more difficult to finance housing over the entire forecast horizon. WIFO expects only a slight recovery in construction investment by an average of +1 percent per year in 2025-2029.

Despite the demographic change and a shrinking working population, the labour supply is still expected to increase by 0.1 percent by the end of the forecast period in 2029. In the medium term, however, this will intensify the labour shortage. On the one hand, this clouds the medium-term growth prospects, but on the other hand it noticeably dampens unemployment: the unemployment rate already fell below the pre-crisis level of 2019 in 2022 and will be 5.7 percent in 2029.

The strong inflation observed since the end of 2021 (2022 +8.6 percent, 2023 +7.8 percent) will slow to 3.1 percent in 2024. By mid-2025, the inflation rate will reach the ECB's 2 percent target and is likely to remain there in the medium term (Ø 2025-2029 +2 percent p.a.). The decline in inflation will also dampen real per capita wage growth to an average of ½ percent p.a. in 2025-2029 (2024 +4½ percent, Ø 2010-2019 +0.1 percent p.a.).

The deficit ratio is 4 percent of nominal GDP in 2025 and averages 3¾ percent over the entire forecast period. As a result, government debt increases from 80 percent (2024) to 86½ percent of nominal GDP by 2029.

Greenhouse gas emissions are likely to fall further, but not enough to meet the target of climate neutrality by 2040. In 2029, emissions are likely to be 39 percent above the current target path.