Christmas Business in Retail 2024 Roughly at Previous Year's Level

"The economic weakness in the Austrian economy, which has persisted since mid-2023, is lowering the spending of private households and is also dampening business in the retail sector. However, the slowdown in inflation has stabilised retail sales over the course of the year," says Bierbaumer.

WIFO forecasts that net sales in the non-food retail trade will increase slightly in value terms in December 2024 (+0.3 percent compared to the previous year). Adjusted for prices, this results in a slight decline of 0.2 percent. Sales in the food retail sector are forecast to increase by just over 4 percent in December. With an expected price increase of 2½ percent, the volume sold will rise by just over 1½ percent compared to the previous year.

For the retail trade (excluding motor vehicles, motor cycles and fuel), nominal growth of 2 percent and price-adjusted growth of around +0.5 percent is expected for December. According to preliminary estimates, this results in an increase of 2.7 percent (value) and 0.7 percent (volume) for 2024.

Business development in the Austrian retail sector has been characterised by continued weak consumer demand and the prevailing economic uncertainties in the year to date. In the first half of the year in particular, sales were very sluggish and declined on a price-adjusted basis. Sales did not stabilise until the middle of the year. With below-average price increases compared to the two previous years, positive real sales growth was recorded. From January to October, the entire retail trade (excluding motor vehicles, motor cycles and fuels) recorded an increase in sales of 2.5 percent (value) and 0.5 percent (volume).

Price momentum in the non-food and food sectors was mostly below inflation during this period. It was not until October that prices in the food sector began to rise more strongly again and are likely to be above headline inflation in the forecast period (until January 2025). Inflation in the non-food sector remains weak and is expected to remain below 1 percent in the forecast months.

In December, the value of sales is higher than in other months for most retail sectors. For many sectors, good December sales are crucial for the annual balance sheet. Overall, the retail trade (excluding motor vehicles, motorcycles and fuels) generated almost a fifth more turnover in December 2023 than in the rest of the year. For individual non-food sectors, these sales peaks were even higher in some cases (including retail of toys, books, watches and jewellery).

However, the level of these December peaks has been falling continuously for years, both for the retail trade as a whole and in many of the individual sectors. There are many reasons for this downward trend. Changes in consumer behaviour in the run-up to Christmas, such as the increased use of November promotion days and weeks around Black Friday, lead to a shift in sales to November. Another aspect is the trend towards cash gifts and vouchers, which leads to a shift in sales to January, as sales can only be recognised when the vouchers are redeemed. A decline in the importance of Christmas can also be observed. General consumer behaviour has also changed over time. Households are spending more on services (e.g., holidays, leisure activities, eating out). With a "constant" household budget, this is at the expense of spending on goods from bricks-and-mortar retailers. The steady increase in online retail and the dominance of large foreign platforms (such as Amazon and Zalando), coupled with an increasing number of new international sales platforms (such as Temu and Shein) are also fuelling the general trend of falling additional sales in the domestic retail trade.

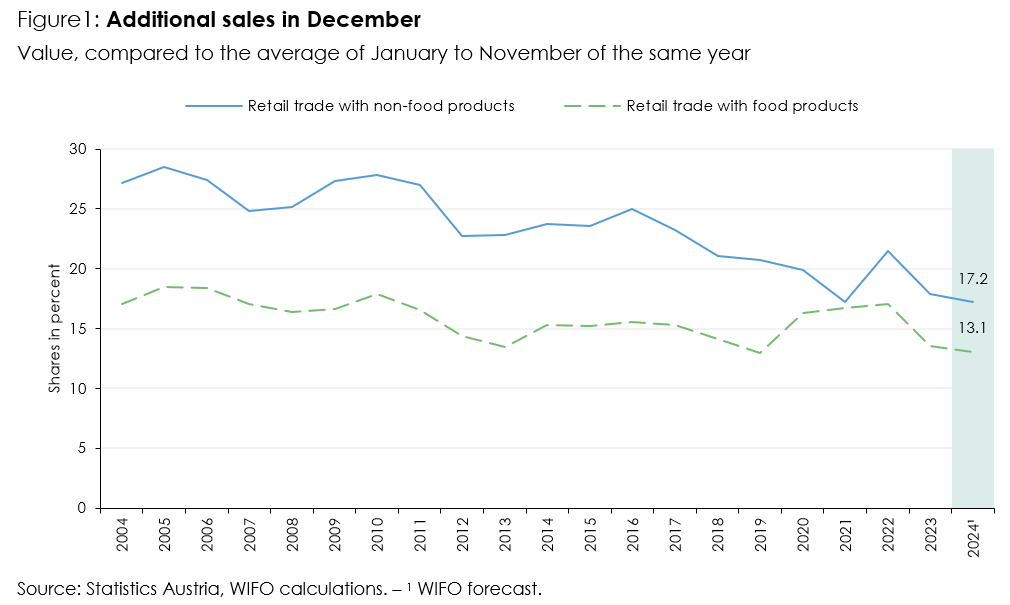

An analysis of these additional sales in the period from 2004 to 2024 illustrates this development (Figure 1). While the value of additional sales in the non-food sector averaged around a quarter between 2004 and 2017, they fell to around a fifth between 2018 and 2024. Based on the current forecast, the figure for 2024 is 17.2 percent. This trend is much less pronounced in the food sector, where additional sales fluctuate around 15½ percent. At the current margin, the figure is likely to be just over 13 percent.

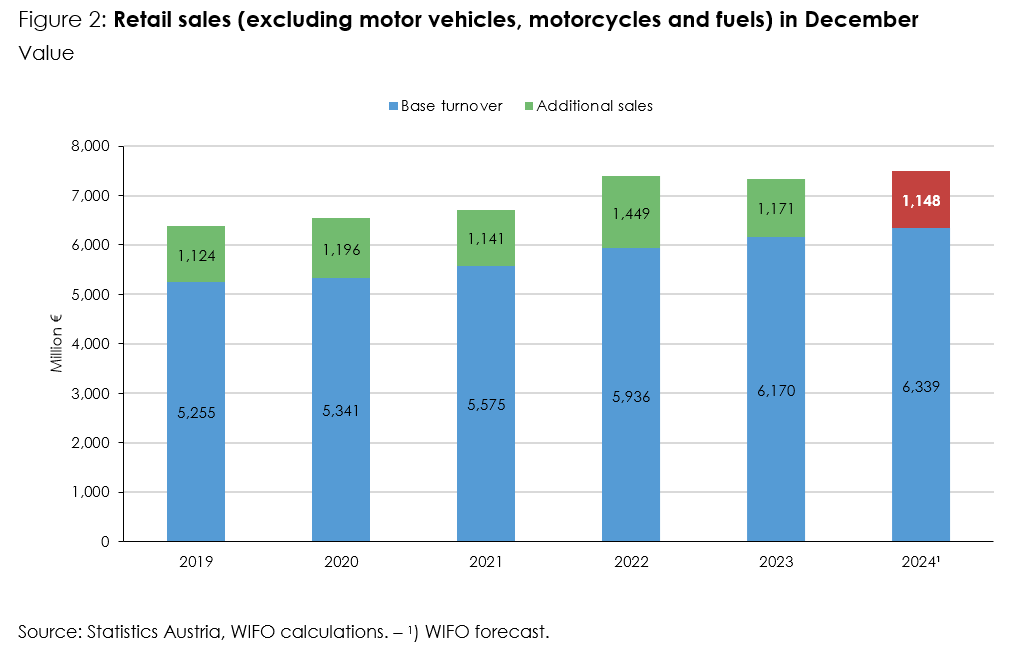

WIFO calculates that this year's Christmas sales will be nominally 1.15 billion € higher than the average from January to November (Figure 2). According to preliminary calculations, this is slightly below the previous year in nominal terms (2023: 1.17 billion €). Adjusted for prices (in volume terms), this represents a slight decline of 0.3 percent. It should be noted that in this year's Christmas business, the first shopping Saturday in Advent fell in November and 8 December – typically an additional "shopping Saturday" – fell on a Sunday. Of this nominal increase in sales, around 60 percent is attributable to the non-food retail sector and 40 percent to the food retail trade.

When looking at the Christmas-related additional sales including the months of November (keyword: shift in sales to November due to Black Friday) and January (keyword: sales generation due to voucher redemptions), preliminary calculations show that the corresponding additional sales in these three months – compared to the average from February to October – will be higher than in 2023.

Methodological note and data basis

WIFO defines Christmas sales in the retail trade (excluding motor vehicles, motorcycles and fuels) as those additional sales in December that exceed a certain "normal level". The average sales trend from January to November is used as a benchmark. Calendar-related effects (such as the number of sales days or their distribution) are also included in the estimate on a weighted basis. Economic developments, external conditions and changes in consumer behaviour are also taken into account.

The turnover indices of retail trade from Statistics Austria's short-term business statistics are available as a data basis. These include net domestic sales of companies subject to VAT.