Weekly WIFO Economic Index

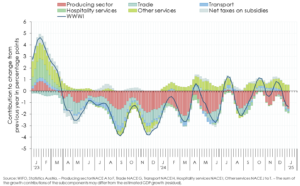

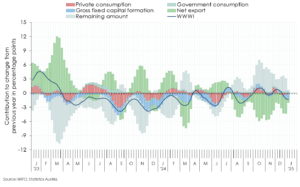

WWWI for GDP and its subcomponents

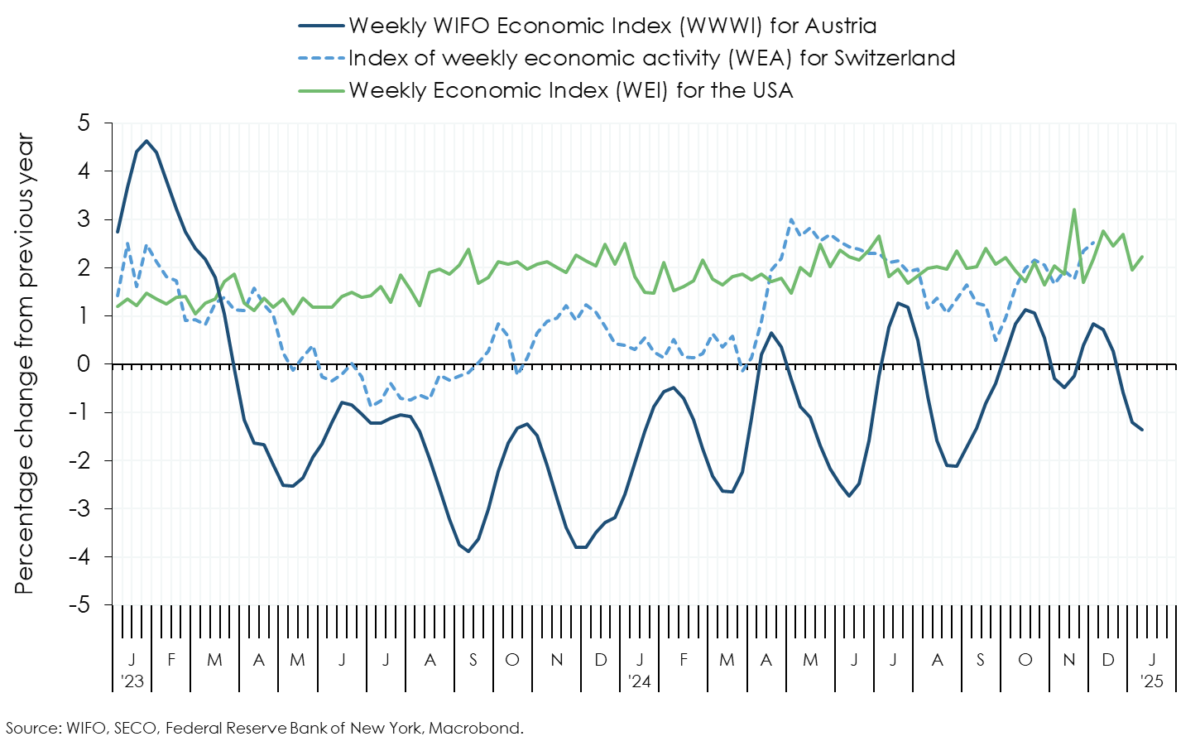

Based on the weekly GDP indicator (WWWI), domestic economic output was ¼ percent higher in December 2024 (calendar weeks 49 to 52) and 1¼ percent lower in the first half of January 2025 (calendar weeks 1 and 2) than in the previous year (November –¼ percent, revised)1.

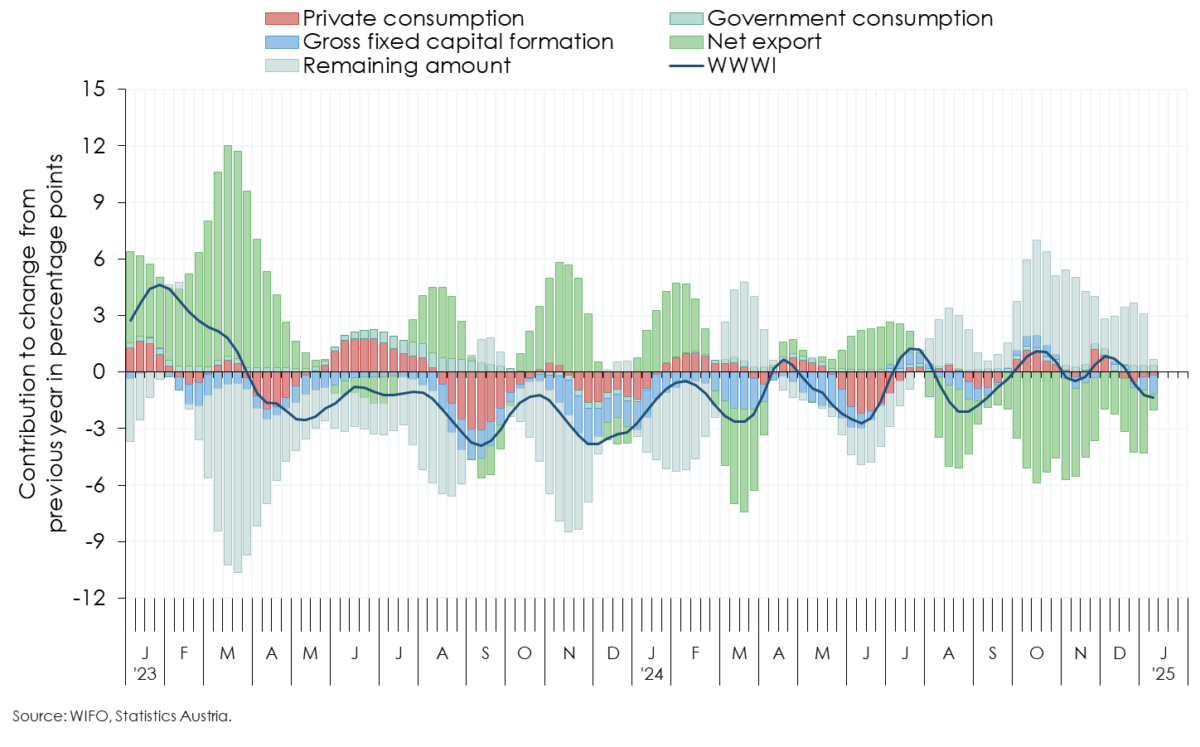

The inflation-adjusted volume of non-cash transactions as an indicator of household consumption expenditure shows a moderate year-on-year increase in demand for goods (retail sales) in December, while demand for services is estimated to have fallen slightly. Private consumption is estimated to have stagnated in December at the level of the previous year and to have fallen by ½ percent in the first half of January (November +½ percent).

The development of gross fixed capital formation is determined by economic output (industrial production) and sentiment in the manufacturing sector (according to the WIFO-Konjunkturtest, business cycle survey). In December, investments are expected to have stagnated at the level of the previous year (November –1¾ percent).

Developments in industrial production and tourism, as well as in the main components of demand and the resulting effects on external trade, resulted in a negative contribution of net exports to GDP growth of 2½ percentage points in December (November –4¼ percentage points).

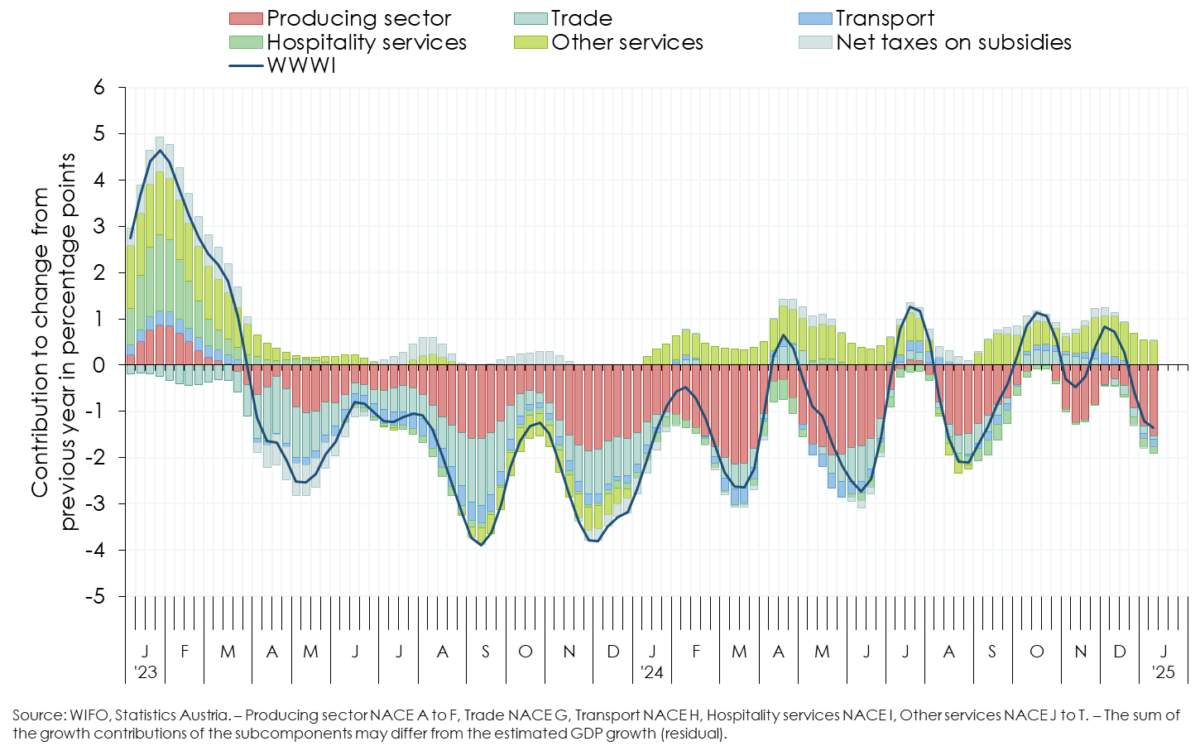

The number of trucks on Austria's motorways, freight transport by rail and the number of passenger flights handled at Vienna Airport increased in December, while the number of freight flights continued to rise strongly. According to the WIFO-Konjunkturtest, the assessment of the future business development (expectations for the coming months) of companies in the transport sector improved slightly in December, although the majority still remains in negative territory. On the basis of these indicators, value added in the transport sector (NACE 2008, section H) is estimated to have increased by 2¾ percent year-on-year in December (November +2½ percent).

Employment in the goods-producing sector (NACE 2008, sections A to E) has continued to decline due to the recession, and the number of unemployed has been rising at double-digit rates year-on-year since November 2023. The WIFO-Konjunkturtest continues to show no significant improvement in sentiment, either in the assessment of the current situation or in the expectations for the coming months. WIFO expects economic output to have declined by 2½ percent year-on-year in December and to have contracted further in the first half of January (November –5 percent)2.

Sentiment indicators for construction remained gloomy. The two-year rise in the number of persons registered as unemployed in construction, which had even reached double digits between March and September, was interrupted in December. The number of people registered as unemployed fell for the first time compared with the same month a year earlier, while employment stagnated. Value added in construction (NACE 2008, section F) is estimated to have been 1 percent lower in December than in the same period of the previous year (first half of January –2¼ percent, November –2 percent).

Based on cashless transactions in the restaurant and hotel sector, sentiment indicators from the WIFO-Konjunkturtest and online searches by foreign guests, value added in tourism (accommodation and food services, NACE 2008, section I) is estimated to have been 1¾ percent lower in December than in the same period of the previous year. It is also likely to have remained well below the previous year's level in the first half of January (November –1¼ percent). After a slight increase in the third quarter of 2024 (+¾ percent), retail sales continued to recover. In the fourth quarter they rose by 2½ percent overall (December +½ percent). In the wholesale and retail trade sector (NACE 2008, section G), value added is estimated to have fallen by 1¼ percent year-on-year in December (first half of January –1 percent, November +1¾ percent).

The current employment situation in the remaining market services and sentiment indicators from the WIFO-Konjunkturtest point to a slight improvement in this sector, and the dampening effect from manufacturing is also likely to have diminished somewhat. In the remaining market services (NACE 2008, sections J to N), value added is estimated to have increased by 2 percent year-on-year in December (first half of January +1 percent, November +1 percent). In other personal services (NACE 2008, sections R to T), value added based on price-adjusted non-cash payments in the entertainment sector is estimated to have increased by ½ percent in December compared with the previous year (first half of January +¼ percent, November +2 percent).

1 The inclusion of newly published monthly data, which must be taken into account when estimating the WWWI, led to a revision of the WWWI. Notable downward revisions on the production side occurred in particular in the goods producing sector (NACE 2008, sections A to E). Larger upward revisions were made for the remaining market services (sections J to N), trade (section G) and construction (section F).

2 For the WWWI estimates, unadjusted weekly and monthly data are modelled on a year-on-year basis. In particular, in the goods-producing sector and closely related market services and construction, one more working day in December than in the previous year affect the calculations and temporarily leads to better results. In November, there was one working day less than in the previous year.

Weekly Economic Activity, WWWI – Production, WWWI – Demand The WWWI is under constant development; it is regularly reviewed and will be expanded with new and additional weekly data series as they become available. The WWWI is not an official quarterly esti-mate, forecast or similar of WIFO.

The WIFO Weekly Economic Index (WWWI) is a measure of the real economic activity of the Austrian economy on a weekly and monthly frequency. It is based on weekly, monthly and quarterly time series to estimate weekly and monthly indicators for real GDP and 18 GDP sub-aggregates (use side 8, production side 10) of the Quarterly National Accounts.

With the release for June 2022, the econometric models for the historical decompositions and for nowcasting have been converted to seasonally unadjusted time series. In addition, year-on-year growth rates are now used to estimate the models.

The WWWI estimates are (currently) updated monthly and published on the WIFO website.