Deepening Recession with Rising Interest Rates and High Inflation

"The sharp rise in domestic banks' net interest income since the ECB's interest rate reversal is related, among other things, to the high share of variable-rate housing loans to private households," says Stefan Schiman-Vukan, author of the current business cycle report.

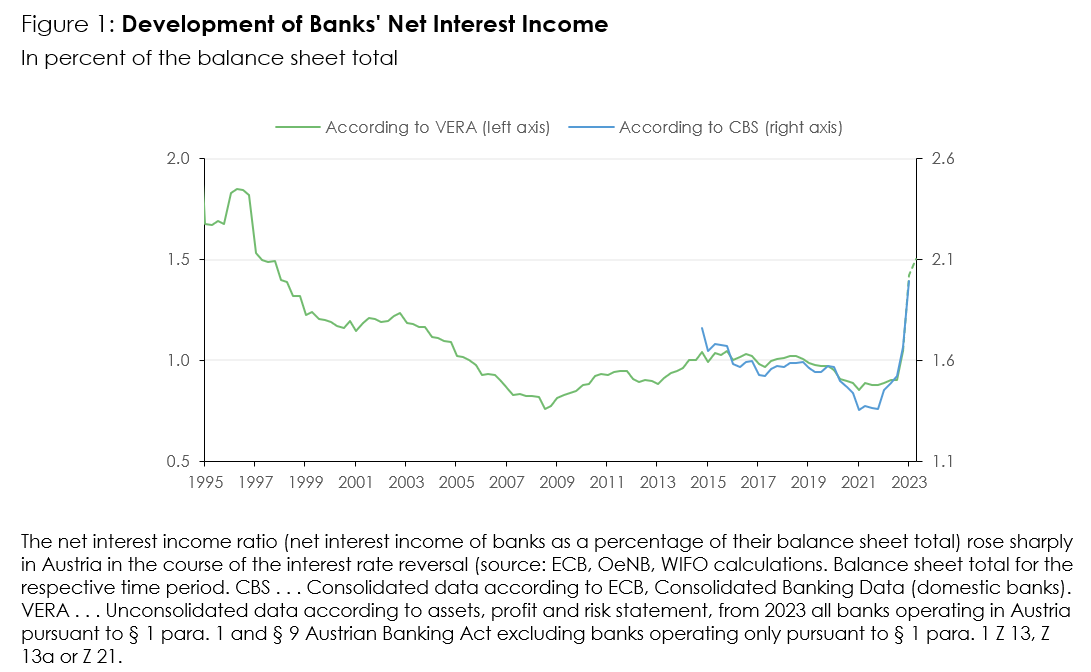

The inflation gap to the euro area increased again in August after a temporary decline. The domestic labour market is currently characterised by a strong expansion of foreign labour supply. Contrary to public perception, savings interest rates have risen more strongly than lending rates since the ECB's interest rate reversal. At the same time, domestic banks have been able to significantly increase their net interest income. This is partly due to the high share of variable-rate housing loans.

The business cycle has deteriorated further recently in both the euro area and Austria. After revising the data for Ireland, which were distorted by the bookings of multinationals based there, economic output in the euro area barely grew in the second quarter of 2023. In Austria, it even shrank quite significantly (–0.7 percent compared to the previous quarter). The sentiment indicators available until August suggest a further economic slowdown, which is likely to be severe in some cases and affect most euro countries and all sectors.

The domestic labour market has seen a simultaneous increase in employment and unemployment since April 2023, as was last observed in the wake of the liberalization towards Eastern European EU member states from 2011 to 2016. This co-movement indicates a disproportionate (non-cyclical) expansion of the labour supply, to which people from Syria and Ukraine in particular contribute. In turn, the decline in job vacancies indicates that the increase in labour supply meets a decline in labour demand.

The inflation rate rose again in Austria in August, while it stagnated in the euro area. The inflation gap, which had been consistently above 2 percentage points in the first half of the year and had fallen in July, increased again to over 2 percentage points. In response to high inflation, the ECB has raised its key interest rates substantially within a year. Recently, there has been increasing criticism that commercial banks are not passing on these interest rate increases sufficiently to their deposit customers.

However, savings interest rates have actually risen somewhat more than lending interest rates (new business) since the ECB's interest rate reversal. This applies to both private households and companies and to the euro area as a whole as well as to Austria. The public perception that deposit rates are (too) low is mainly based on overnight deposit rates. However, such deposits are not primarily used for investment purposes, but serve a similar purpose as (non-interest-bearing) cash. As a result, overnight deposit rates remain lower than those on time deposits when policy rates are raised.

While policy rate increases have so far been passed on to companies and private households in a manner that is reasonable from a market economy point of view, the net interest income of many commercial banks has increased significantly since the turnaround in interest rates. This increase in profitability is linked, among other things, to the share of variable-rate housing loans, which varies considerably from country to country: in countries with a high share, the net interest income ratio rose by up to three quarters, while in France, where there are hardly any variable interest rates on housing loans, it fell. In Austria, which is in the middle of the euro area in terms of the share of variable rates on housing loans, net interest income increased by about one third between the second quarter of 2022 and the first quarter of 2023.

Please find the entire business cycle report here (German version).

Publications

Please contact