Recession in Austria Continues

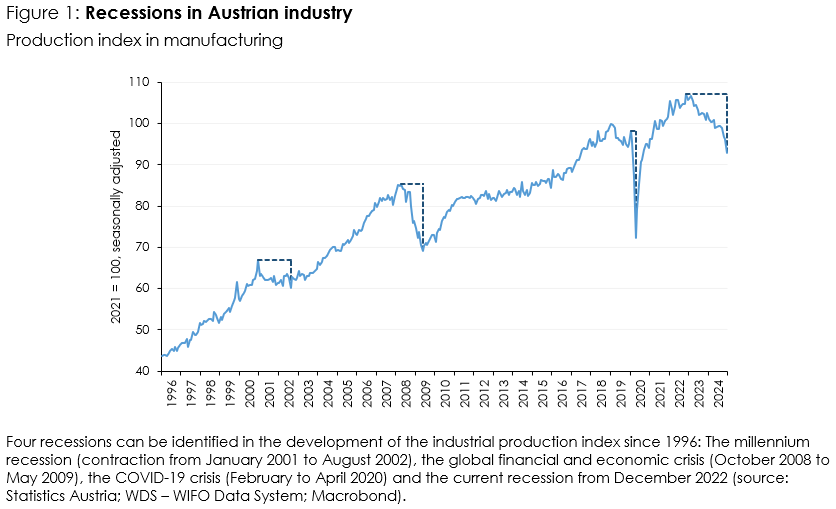

"The current industrial recession has already lasted longer than the last three crises and is also likely to result in the largest production losses", says Marcus Scheiblecker, author of the latest WIFO Business Cycle Report.

According to the new national accounts data from Statistics Austria, Austria's economic output fell by 0.4 percent in the fourth quarter of 2024, and thus somewhat more sharply than in the third quarter (–0.3 percent compared to the previous period). As the figures for the first three quarters of 2024 have been significantly revised downwards, too, GDP for the year 2024 as a whole is now estimated to have fallen by 1.2 percent (volume, preliminary). This means that the recession deepened compared to 2023 (–1 percent).

Weak international demand for industrial products is dampening production in the euro area. In Germany, the industrial production index contracted for the third consecutive year in 2024. Business expectations do not yet point to a significant improvement in the industrial economy, but rather to a continued crisis. The increasingly concrete threat of US tariffs on goods from the EU is likely to weigh on European industry in the coming months.

The economy in the USA has been robust so far, although uncertainty has increased in light of the new government's economic policy decisions. GDP expanded by 0.6 percent in the fourth quarter of 2024, barely weaker than in the previous period. The inflation rate has been on an upward trend since September 2024 and increased further to 3.0 percent in January (December 2024: 2.9 percent). This development and the prospect of new import tariffs are fuelling expectations of a renewed rise in inflation. This is dampening private household's willingness to spend.

The weak economy in the euro area is hitting Austrian industry hard, as well. While production has been trending downwards since the beginning of 2023, the downturn accelerated at the end of 2024, with company surveys only pointing to a slowdown in the downward trend in the coming months. The threat of tariffs from the USA, Austria's second most important trading partner, is weighing on companies' sentiment.

By contrast, the Austrian construction sector seems to have bottomed out. An increase in new mortgage loans, the more favourable interest rate environment and the expected easing of lending guidelines in mid-2025 are improving the general conditions for construction investment.

Consumer demand, which stabilised in the fourth quarter of 2024, also tends to gain momentum. The volume of retail sales picked up in the second half of 2024. New car registrations have risen sharply in recent months. Only consumer confidence is weakening, weighed down by fears about jobloss and the large number of company insolvencies.

Domestic tourism continues to thrive. After a record number of overnight stays in summer 2024, a new high is also in sight for the 2024-25 winter season. Although the high demand is far from compensating for the loss of production in the industry, it is cushioning the downturn.

The inflation rate shot back up to 3.2 percent at the start of 2025 due to the expiry of the electricity price brake, the rise in fossil fuel prices and the weak euro. According to Statistics Austria's flash estimate, it rose further to 3.3 percent in February.

The labour market is still proving to be relatively robust in view of the economic downturn. Although the unemployment rate rose significantly compared to the previous year, it has almost stagnated in recent months (seasonally adjusted). According to the preliminary estimate by the Federal Ministry for Labour and Economy (BMAW), the seasonally adjusted number of employees in February 2025 was higher than in the previous month, despite the recession. However, the increase was lower than the loss of jobs at the beginning of the year.

Publications

Please contact