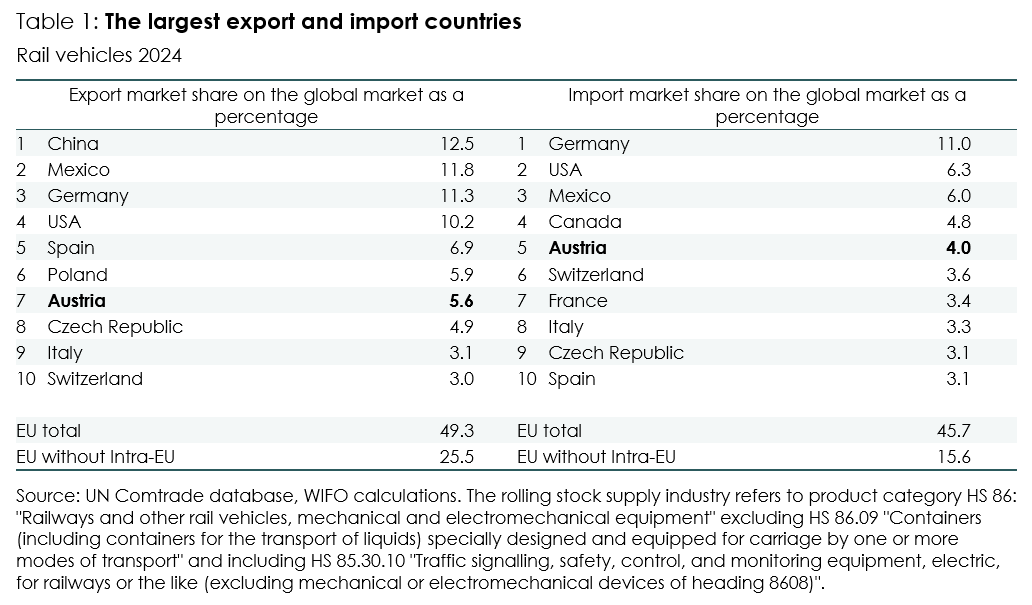

The Competitive Situation in the Global Rolling Stock Supply Industry

However, the European rail vehicle technology industry is currently facing competition from Chinese manufacturers not only in third markets but also in its traditional home markets. In Austria, an order placed by the private Austrian railway company Westbahn GmbH with the Chinese state-owned Chinese Railway Rolling Stock Corporation (CRRC) has sparked debate. CRRC is the world's largest manufacturer of rail vehicles, with a dominant market share in China. This poses an industrial policy challenge for Austria and the EU, not only in terms of exports, jobs, and innovation capacity, but also because the rail industry, and with it the rolling stock supply industry, has a security policy dimension.

The available empirical evidence, in particular the OECD study (2023)1, suggests that China uses a wide range of state aid (government subsidies, tax breaks, and preferential loans) in the rail vehicle industry to support its own industry domestically and in exports. This has an impact on competition, as state aid makes it possible to offer lower prices given a certain level of technological expertise. Forced technology transfer has enabled it to gain a dominant position in the domestic market and make its products technologically competitive. After initially targeting mainly developing countries, Asia, and America, CRRC is now also trying to gain a foothold in EU markets. In the USA, aggressive countermeasures were taken from 2019 onwards to exclude Chinese producers from the regional passenger rail transport market.

The economic policy instruments that can be used to address these challenges are primarily European in scope and have been refined in recent years. The instruments range from punitive tariffs and exclusion from public tenders in the case of distorting subsidies to investment controls on foreign direct investment and competition policy such as merger control. At the national level, public procurement law is likely to be a suitable instrument. Security policy aspects have been given less consideration in the EU to date. These instruments are fundamentally defensive in nature, i.e., they address the European internal market but not third markets. However, these instruments can also be used as bargaining chips or potential threats to achieve a reduction in Chinese state aid.

1 OECD (2023). Measuring Distortions in International Markets: The Rolling-stock Value Chain. OECD Trade Policy Papers, (267).