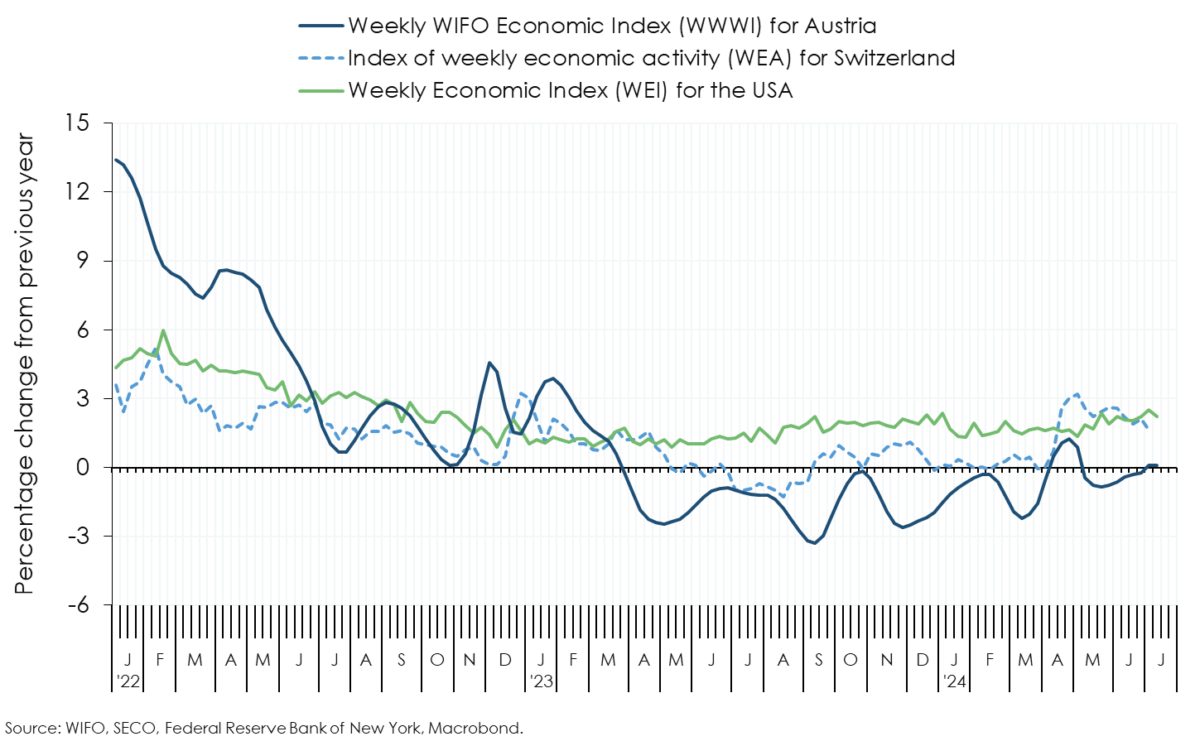

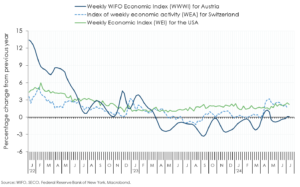

Weekly WIFO Economic Index

WWWI for GDP and its subcomponents

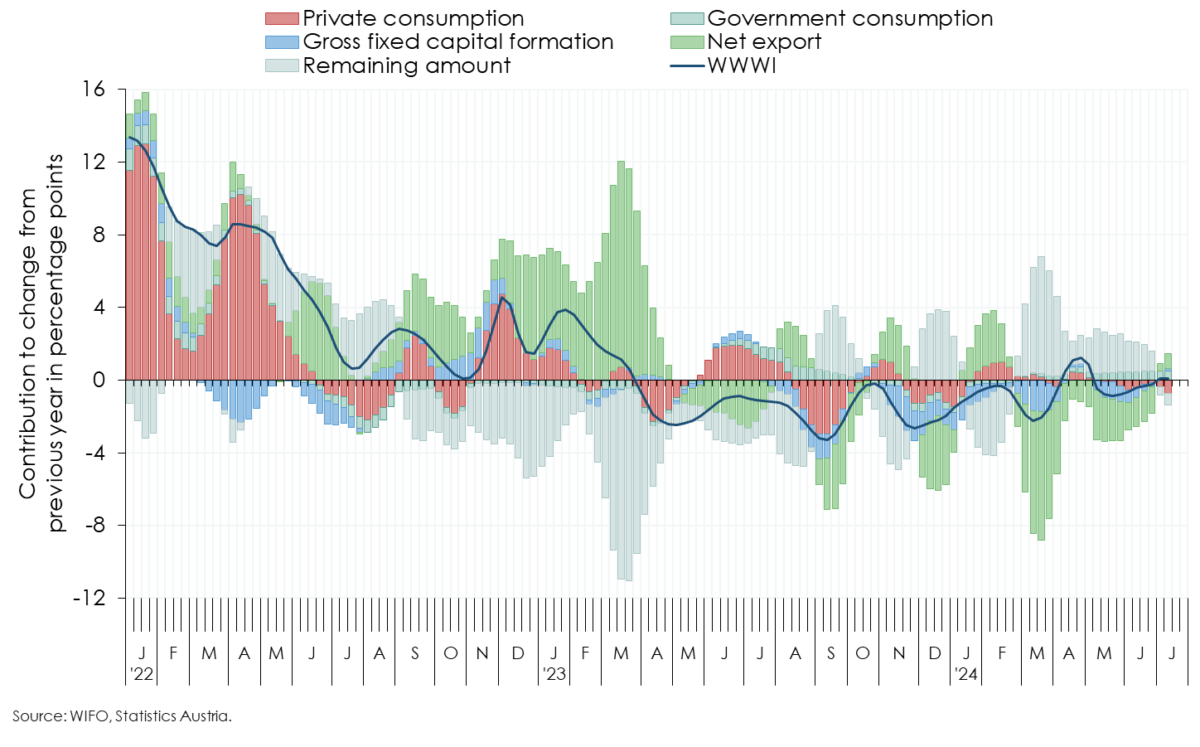

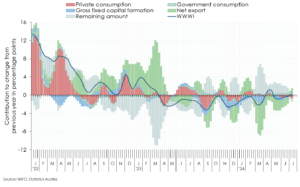

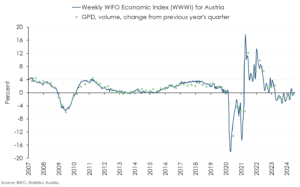

Based on the weekly indicator of real GDP (WWWI), domestic economic output in June (calendar weeks 23 to 26) remained ½ percent below the level of a year before, as in the previous month. In the first half of July (weeks 27 and 28), output is estimated to have been at the same level as a year earlier1.

The inflation-adjusted volume of non-cash transactions, as an indicator of household consumption, shows roughly equal year-on-year declines in demand for goods (retail sales) and services in June. Private consumption is therefore estimated to have fallen by ½ percent in June compared to the previous year and by 1 percent in the first half of July (May ±0 percent).

The development of gross fixed capital formation is determined by economic output (industrial production) and sentiment in the manufacturing sector (according to the WIFO-Konjunkturtest, business cycle survey). For June a decline of 1¾ percent year-on-year is estimated (May –2½ percent).

The decline in industrial production and in the major components of demand, and the resulting impact on foreign trade, resulted in net exports in the broad sense making a negative contribution to GDP growth of 1½ percentage points in June (May –2¼ percentage points).

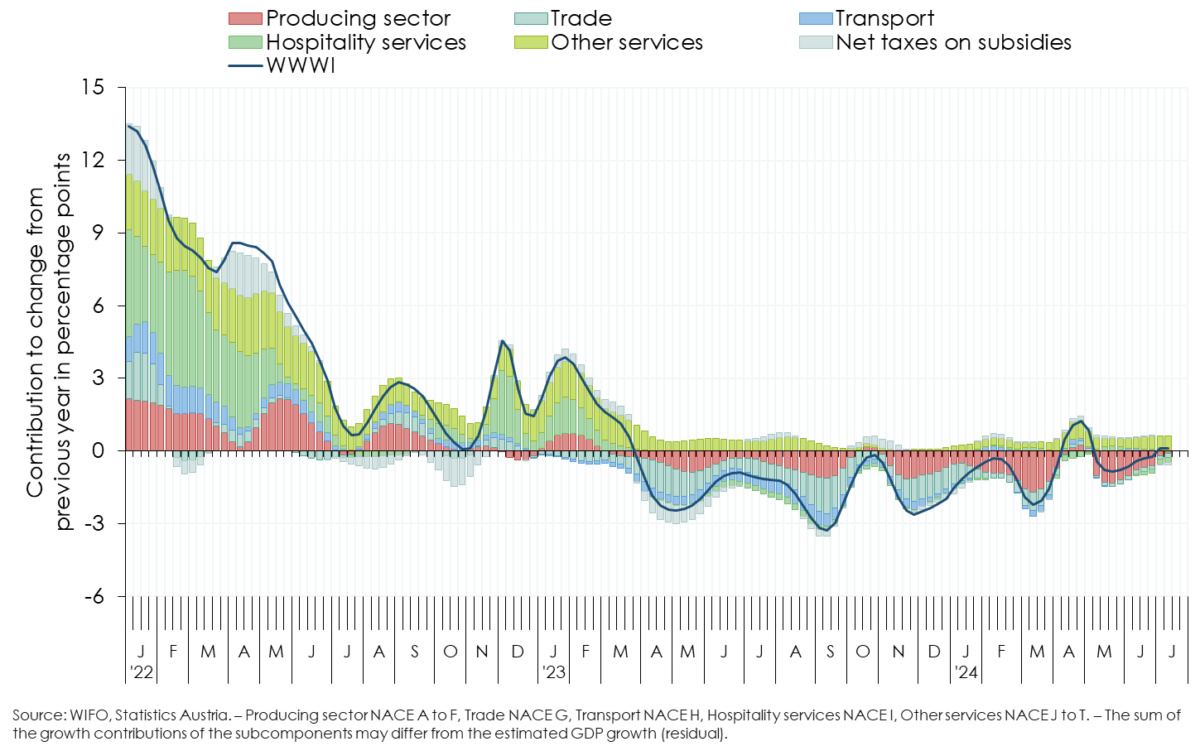

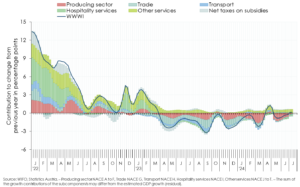

The number of trucks on Austria's motorways, the volume of rail freight traffic and the number of passenger flights handled at Vienna Airport increased in June, while the number of freight flights has been rising strongly since the beginning of the year. However, according to the WIFO-Konjunkturtest, the business climate in the transport sector deteriorated again in June. Together with the development of freight transport indicators, value added in transport (NACE 2008, section H) is estimated to have increased by 2 percent in June compared to the previous year (May +¼ percent).

Employment in the goods producing sector (NACE 2008, sections A to E) fell in June for the sixth time in a row due to the recession, and the number of jobseekers has been rising at double-digit rates year-on-year since November 2023. The WIFO-Konjunkturtest does not yet show any improvement in sentiment, neither in the assessment of the current situation nor in the expectations for the coming months. WIFO expects value added in the goods producing sector to have been 2¾ percent lower in June than a year earlier and ¼ percent lower in the first two weeks of July (May –3½ percent).

Sentiment in the construction sector has stabilised somewhat but remains in negative territory. According to the WIFO-Konjunkturtest, the assessment has hardly changed compared to May. The increase in the number of persons registered as unemployed in the construction sector, which has been going on for 1½ years, has been back in double digits since March, while employment has been declining for almost a year. Value added in construction (NACE 2008, section F) is expected to have fallen by 2¾ percent in June and by 1 percent in early July compared to a year earlier (May –3 percent).

Based on cashless transactions in hotels and restaurants, sentiment indicators from the WIFO-Konjunkturtest and online searches by foreign guests, value added in tourism (accommodation and food services, NACE 2008, section I) is estimated to have been 2 percent lower in June and 4½ percent lower in the first half of July than in the same period of the previous year (May +3 percent). The trade sector (NACE 2008, section G) continued to be very weak: in June and early July, value added was 1½ percent below the previous year's level (May –¾ percent).

The persistently unfavourable development in the producing sector is dampening the momentum in remaining market services (NACE 2008, sections J to N), as the current employment situation and the sentiment indicators of the WIFO-Konjunkturtest also show. Year-on-year, value added fell by ¼ percent in June and rose by ¼ percent in the first half of July (May –½ percent). In other personal services (NACE 2008, sections R to T), value added is expected to have increased by 4¾ percent year-on-year in June and by 4 percent in the first half of July, on the basis of price-adjusted non-cash payments in the events sector (May +5½ percent).

1 The inclusion of newly published monthly data, which have to be met when estimating the WWWI, has led to a revision of the WWWI for GDP: April and May +¼ percentage point, March unchanged. On the production side, noteworthy upward revisions in May occurred in the distributive trades (NACE 2008, section G), transport (section H) and other services (sections R to U), while larger downward revisions occurred in the goods producing sector (sections A to E), the remaining market services (sections J to N) and in construction (section F).

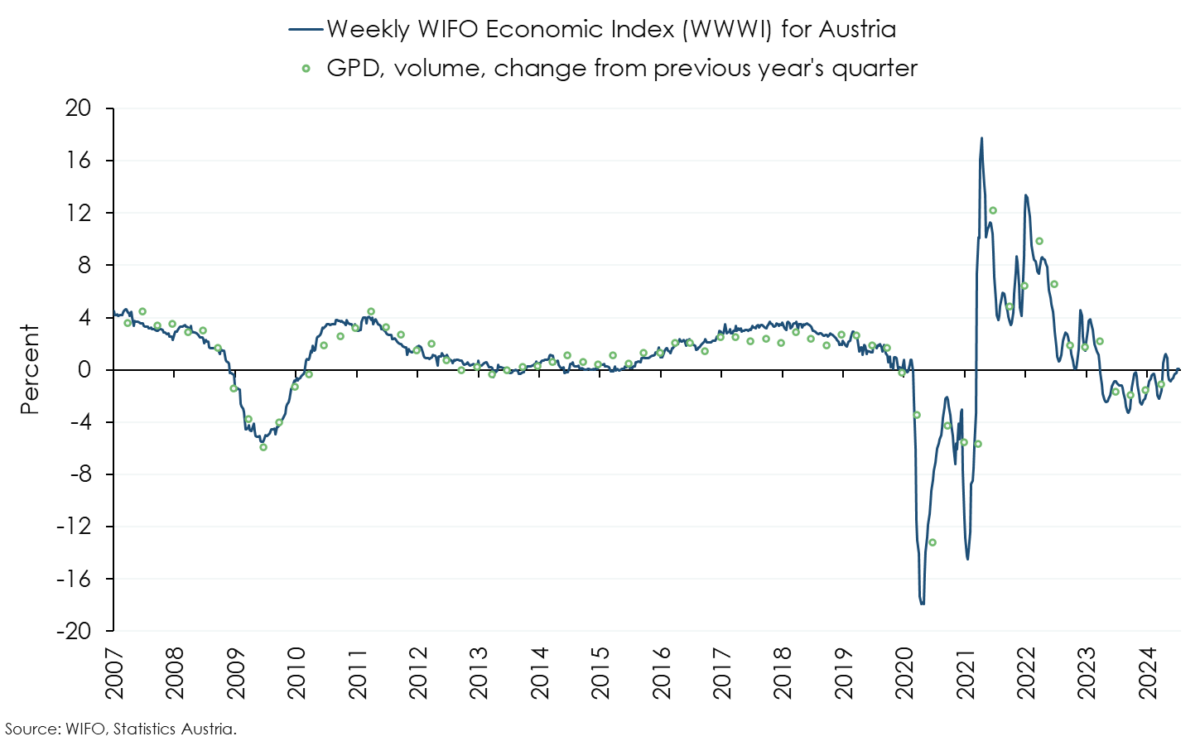

Weekly Economic Activity, WWWI – Production, WWWI – Demand, WWWI (from 2007) The WWWI is under constant development; it is regularly reviewed and will be expanded with new and additional weekly data series as they become available. The WWWI is not an official quarterly esti-mate, forecast or similar of WIFO.

The WIFO Weekly Economic Index (WWWI) is a measure of the real economic activity of the Austrian economy on a weekly and monthly frequency. It is based on weekly, monthly and quarterly time series to estimate weekly and monthly indicators for real GDP and 18 GDP sub-aggregates (use side 8, production side 10) of the Quarterly National Accounts.

With the release for June 2022, the econometric models for the historical decompositions and for nowcasting have been converted to seasonally unadjusted time series. In addition, year-on-year growth rates are now used to estimate the models.

The WWWI estimates are (currently) updated monthly and published on the WIFO website.