Countervailing Duties on Chinese Electric Vehicles

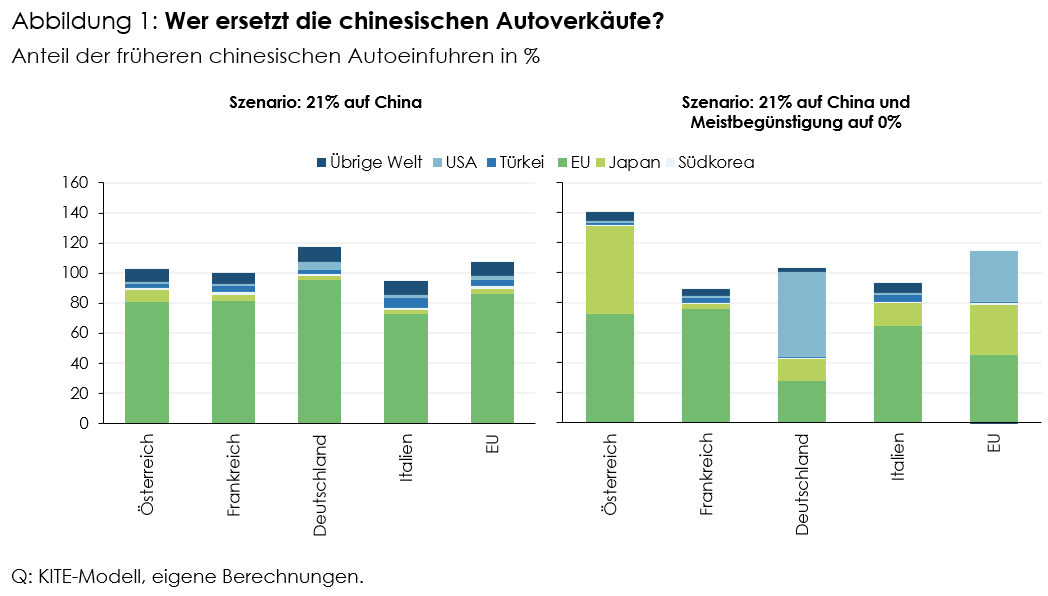

Using simulations from a trade model (the KITE model) encompassing many countries and sectors, the Kiel Institute for the World Economy (IfW Kiel), the Austrian Institute of Economic Research (WIFO), and the Supply Chain Intelligence Institute Austria (ASCII) project that the provisional countervailing duties effective 4 July 2024, will reduce vehicle imports from China by 42 percent. This reduction will be largely offset by higher sales from European producers within the EU and increased imports from third countries. The duties will have a negligible long-term impact on vehicle prices. Electric vehicle prices in the EU might rise by an average of 0.3 to 0.9 percent, while prices in China might decrease. Short-term effects could be more pronounced.

"The value added in the EU auto industry is expected to rise by 0.4 percent, while it will decrease by 0.6 percent in China", says Julian Hinz, Research Director of Trade Policy at IfW Kiel and co-author of the newly released Kiel Policy Brief "Tariffs on Chinese EVs and retaliatory measures." The anticipated increase in prosperity in most EU countries will be minimal, less than 0.01 percentage points.

Abolishing existing import duties?

Apart from the newly decided countervailing duties, the EU currently imposes a 10 percent import duty on cars from WTO member countries without a free trade agreement. Reducing these duties on battery electric vehicles to zero could lower prices in the EU by up to 0.8 percent. Simultaneously, imports from China would only decrease by about 20 percent, while imports from third countries would increase by over 1 percent. "This scenario would enhance EU welfare more than the pure countervailing duty scenario, and the green transformation would benefit from more "fair" trade," states Julian Hinz.

"This approach could demonstrate what the new trade policy doctrine, which aims for trade policy to be "open, sustainable, and assertive," means in practice", says Gabriel Felbermayr, Director of the Austrian Institute of Economic Research (WIFO) and co-author of the Kiel Policy Brief. "With the countervailing duties, the EU supports the multilateral trading system and fair competition. Conversely, by reducing existing import duties, the EU could show that it also pursues the affordability of electric vehicles and the green transformation."

Duties on pork with minimal effects

"In principle, the EU is right in responding to China’s trade-distorting practices with countervailing duties", says Gabriel Felbermayr. "At the same time, the EU should strive to achieve a negotiated outcome and avoid escalation. There is time until early November 2024, when the definitive duties would be imposed. By then, the Commission must also address doubts about its methodology that exist in some member states and adjust the countervailing duties if necessary."

In response, China has announced it will investigate the application of 50 percent anti-dumping duties on pork imports from the EU. This would be particularly challenging for pig farmers in Denmark, Spain, and Germany. However, given that exports have been declining for several years, this measure would likely have minimal impact on EU welfare. Felbermayr comments, "Counter-measures by China, whether legitimate or not, were anticipated. The fact that China has not resorted to harsher measures so far indicates a willingness to negotiate."

Publications

- Gabriel Felbermayr

- Klaus Friesenbichler

- Julian Hinz

- Hendrik Mahlkow

Please contact