Austria Gradually Emerges from Recession

"The downturn in Austria was, according to the latest data, roughly as pronounced as in Germany and unusually protracted, lasting about three years," says Stefan Schiman-Vukan, one of the authors of the current WIFO Economic Outlook.

The Austrian economy is emerging from a recession that, according to new National Accounts data from Statistics Austria, was milder than previously assumed. Simultaneously, Germany's Federal Statistical Office (Destatis) revised its GDP figures downward. Taken together, the revisions yield a coherent picture: the losses in value added were similar in both countries. The recession, which affected Northern, Central, and Eastern Europe, was triggered by the 2022 energy-price shock. Western and Southern European economies were largely spared because they were less dependent on Russian energy supplies.

As WIFO had projected, Austria's recovery is being led not – as usual – by exports of goods but by private consumption, which already expanded noticeably in 2024. During the forecast period, however, consumption will be restrained by the elevated unemployment risk and tight fiscal policy. Foreign trade in goods is not expected to revive until 2026. Weak global demand for capital goods is hitting Austrian exporters hard, and US import tariffs are an additional drag, especially since US demand for Austrian goods had been strong in recent years. The recovery in residential construction, already under way, will continue into 2026 on the back of lower interest rates. In civil engineering, the underlying momentum will be dampened in 2026 by public-sector austerity. Equipment investment will recover only with a lag, as it generally trails the overall business cycle; moreover, weak corporate profits are curbing investment appetite.

Given this unfavourable environment, the trade union accepted a moderate wage agreement in the metalworking industry during the current autumn bargaining round. This is likely to set a precedent for other sectors and to dampen real-wage growth in 2026, which had been comparatively high in Austria in 2024. Previous nominal wage increases are feeding through mainly into service-sector prices. In the current year, the expiration of energy-price relief measures – especially the electricity price cap – is adding to inflationary pressure. Substantial fee hikes by public authorities are also pushing prices higher while supporting the urgently needed consolidation of public finances.

The labour market still bears the imprint of the recession: unemployment is rising, and National Accounts show employment stagnating. In 2026, however, the economic recovery should trigger a turnaround, allowing the unemployment rate to edge down. Demographic change tends to curb unemployment, while pension-system measures that extend working lives help alleviate skill shortages.

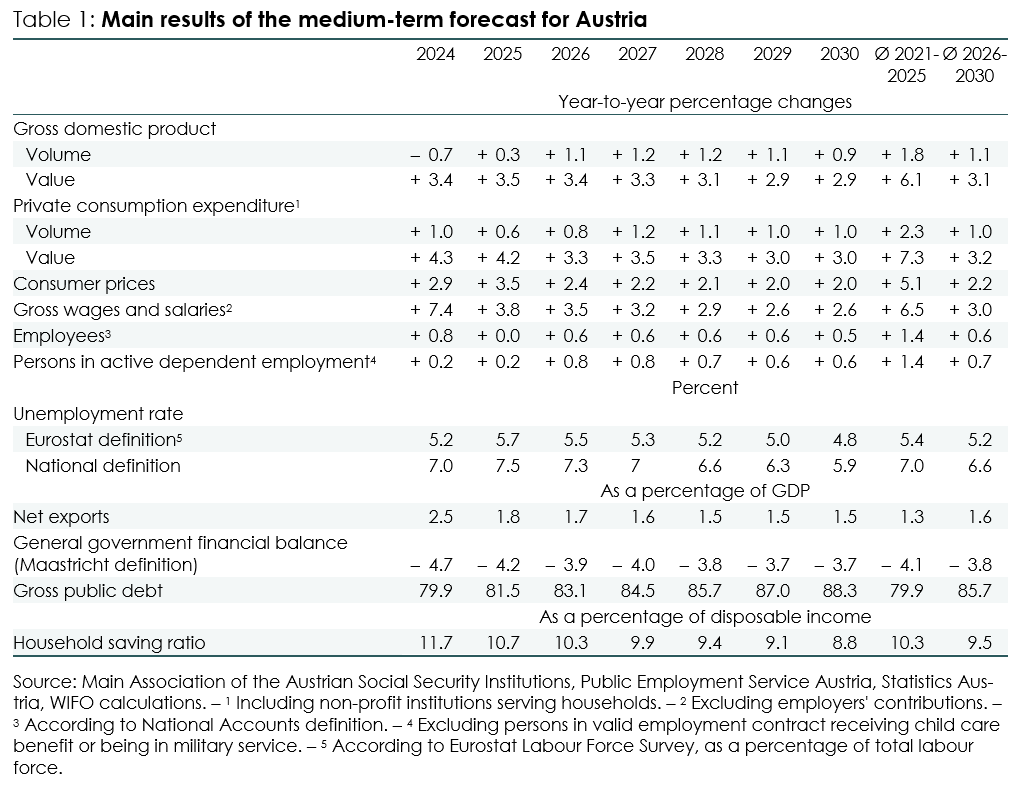

Overall, real GDP will rise by a slight 0.3 percent this year, with growth accelerating to 1.1 percent in 2026.

Medium-term Forecast

Building on the short-term forecast, WIFO projects economic developments for 2027-2030. This medium-term assessment is presented for the first time together with the short-term forecast at a press conference on 7 October 2025.

"In comparison to other European countries, Austria faced a higher increase in energy prices and unit labour costs in recent years. Hence, the energy-intensive export sector therefore suffers from competitive disadvantages even in the medium term. Additional structural challenges include the integration of migrants, the labour force participation of older workers, and shortcomings in the education system. Against this backdrop, Austria's economy is expected to grow 0.2 percentage points more slowly than the euro area average," says Josef Baumgartner, one of the authors of the Medium-term Forecast.

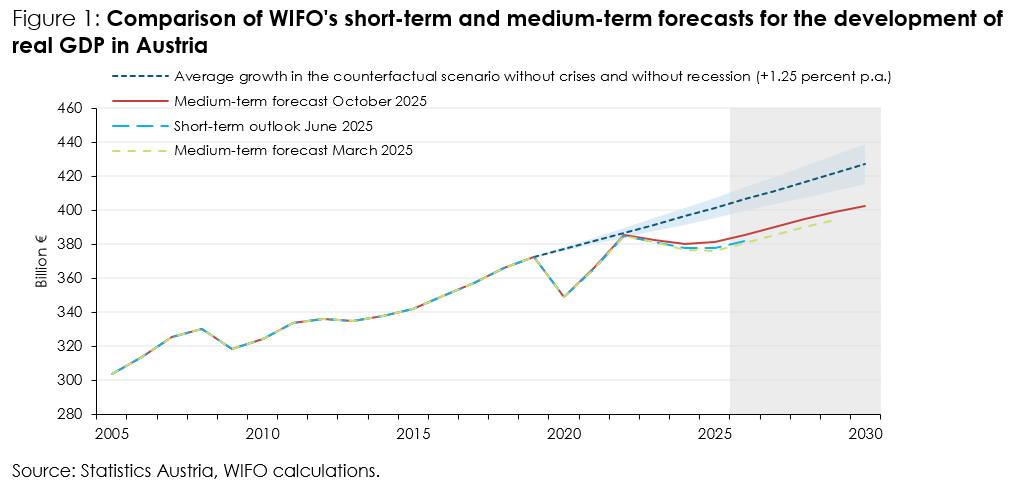

WIFO forecasts real GDP growth of 1.1 percent per year on average for 2026-2030 (Ø 2010-2019 +1.6 percent p.a., see Table 1). Trend growth, calculated according to the European Commission's method, amounts to 0.8 percent per year (Ø 2010-2019 +1.1 percent).

The unemployment rate is projected to fall to 5.9 percent by 2030. After 3.5 percent inflation this year, price growth will decelerate to 2.4 percent in 2026 and reach the ECB's 2 percent target by mid-2027 (Ø 2026-2030 +2.2 percent p.a.).

The general government budget deficit will average 3.8 percent of nominal GDP over 2026-2030, remaining persistently above the 3 percent threshold. Consequently, public debt will rise to 88.3 percent of nominal GDP by 2030.

The COVID-19 crisis, the energy-price shock, and the subsequent recession have significantly eroded Austria's value added. Depending on the assumptions about average growth in a counterfactual, crisis-free scenario, cumulative output losses for 2020-2030 amount to between 135 billion and 270 billion € (see Figure 1).