Economic Climate Worsens, Large Differences Between Sectors

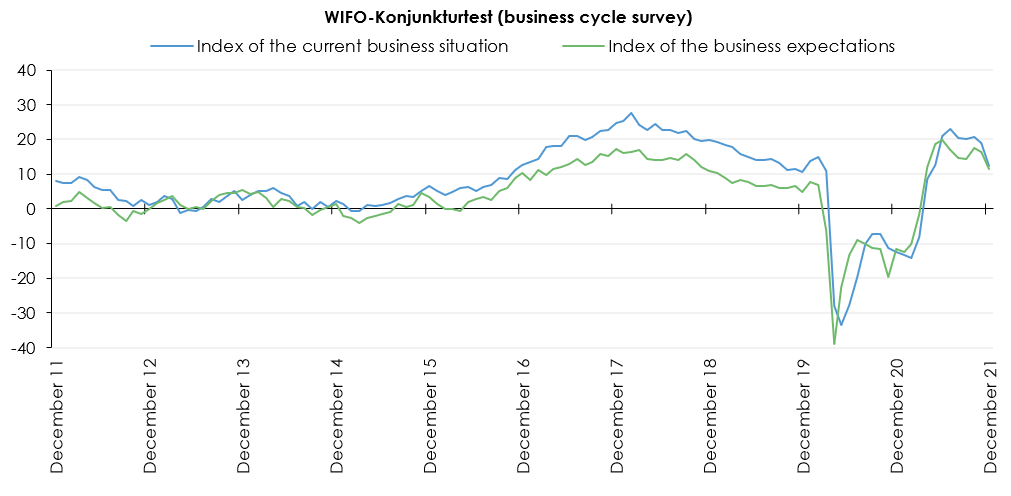

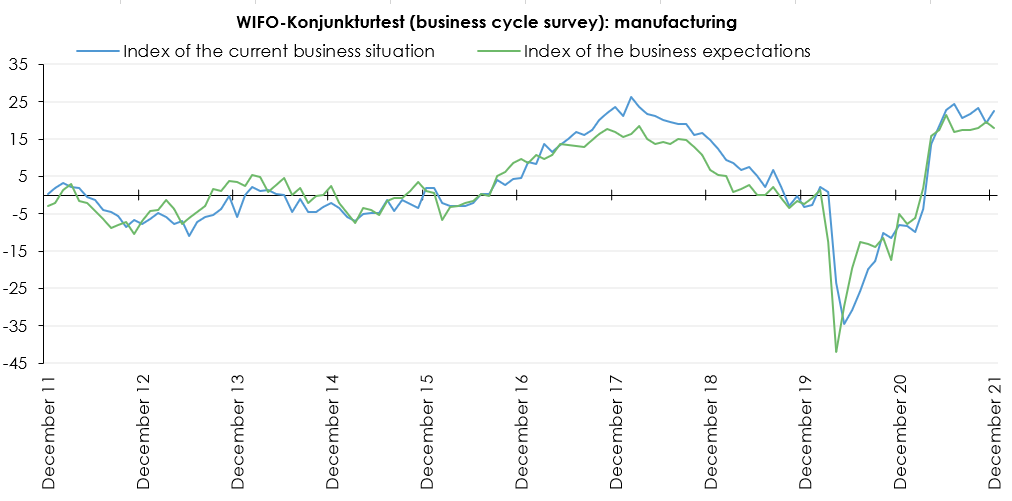

The index of current assessments for the economy as a whole declined by 6.7 points in December but remained in positive territory at 12.4 points. In the retail trade sector, there was a decline (–3.4 points) and the situation index, at –6.3 points, was more clearly in negative territory than in the previous months. In services there was a slump (–15.2 points), but the index remained in positive territory at 5.2 points. The decline in the assessment of the situation was particularly strong in accommodation and catering. In contrast, there were index improvements in the manufacturing sector (+3.1 points) and construction (–0.8 points). The situation indices in both sectors remained well above the zero line (manufacturing 22.5 points, construction 36.9 points).

The index of business expectations declined by 4.7 points in December (seasonally adjusted) but remained positive in the aggregate at 11.6 points. However, non-seasonally adjusted data (light lines) show a more pronounced decline. This leads to interpretational uncertainties in the wake of the impending omicron wave, even though the non-seasonally adjusted declines are systematic over the years and thus should have little cyclical information. Seasonally adjusted, the service sectors see a noticeable decline (–6.4 points to 7.7 points). In retailing, the expectations index slumped (–14.5 points) and was clearly in negative territory at –20.3 points. In the construction industry, on the other hand, the expectations index rose by 4.3 points to 44.1 points and, partly due to price expectations, was in the range of the highest values. In the manufacturing sector the expectations index (seasonally adjusted) lost 1.8 points, but at 17.9 points was still noticeably in the confident range.

Publications

Please contact