Inflation Rate Falls Significantly, but Economic Activity Remains Sluggish

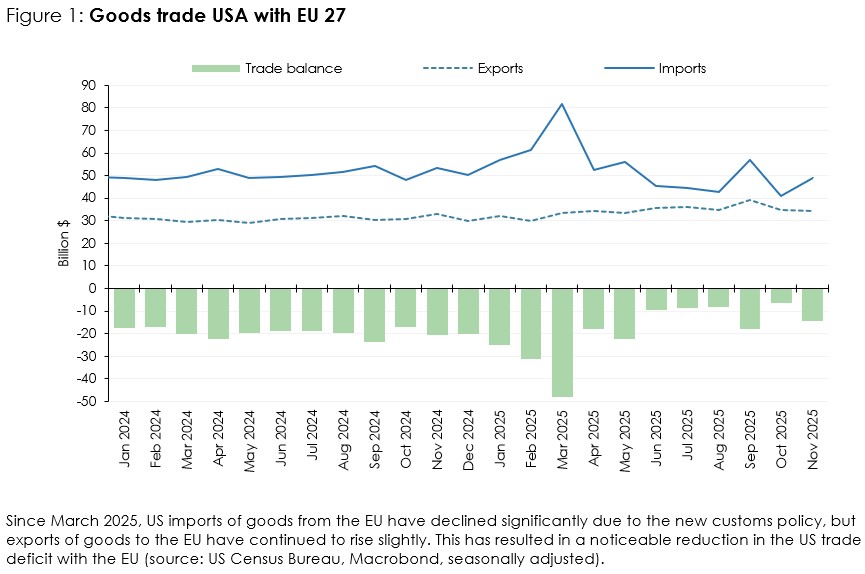

"Customs policy of the USA has reduced imports of goods from the EU in recent months. The Trump administration's intention to reduce foreign dependence appears to start taking effect", says Marcus Scheiblecker, author of the latest WIFO Business Cycle Report.

Having overcome the recession, domestic industry has not yet gained any noticeable momentum and is recovering only slowly. According to the WIFO-Konjunkturtest of January 2026, no sustained improvement in sentiment was yet observable in manufacturing. Weak foreign demand for industrial goods continues to have a dampening effect. Negative assessments also predominate in the construction industry. In contrast, the majority of service providers are positive. The retail trade is also increasingly optimistic about the future.

In the euro area, economic growth remained sluggish in the fourth quarter of 2025, at +0.3 percent. This was due not only to the continuing sluggish domestic economy, but also to weak exports. However, business surveys at the beginning of the year showed a significant improvement in the sentiment, which should keep the euro area on track for growth.

In Austria, real GDP grew by only 0.2 percent in the fourth quarter of 2025, according to preliminary calculations by WIFO. This results in an annual average increase of 0.6 percent compared to the previous year (seasonally and calendar adjusted). Thus, the domestic economy has returned to growth after two years of recession.

Export demand expanded by 0.6 percent in the fourth quarter, but this did not offset the slump in the previous quarter (–1.6 percent). Private household consumption grew by 0.4 percent, following –0.3 percent in the third quarter. Low investment demand continues to have a dampening effect. Gross fixed capital formation shrank by 0.7 percent in the fourth quarter (third quarter –0.1 percent).

The inflation rate, which had remained stubbornly at around 4 percent since the summer of 2025, fell sharply to 2 percent in January according to preliminary calculations. On the one hand, the base effect resulting from the expiry of the energy price brake, which had pushed up the inflation rate throughout 2025, came to an end, and on the other hand, price declines and some newly implemented measures by the federal government dampened energy prices.

The situation on the labour market remains challenging, but there have been signs of stabilisation recently. Although unemployment rose again in January 2026 compared with the previous year, there has been no further increase recently on a seasonally adjusted basis.

Publications

Please contact