Business Cycle Sluggish, Inflation Rising

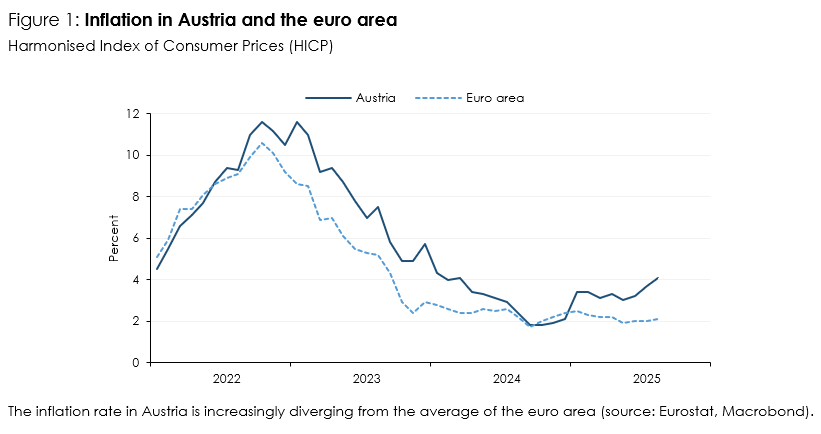

"After the inflation rate in Austria was lower than in the euro area as a whole in the fourth quarter of 2024, it was around 1 percentage point higher on average in the first half of 2025. The gap widened further in July and August", says Marcus Scheiblecker, author of the latest WIFO Business Cycle Report.

Austria's economy is still struggling to emerge from the longest recession in the post-war period. GDP rose by 0.3 percent in the second quarter compared to the previous period, after 0.2 percent at the beginning of the year. The weak industrial economy in the euro area is still a drag on the overall performance. The significant rise in the industrial production index at the start of the current year was followed by a slight decline by the middle of the year. In the first quarter of 2025, increased imports from the USA are likely to have favoured European industrial production. However, demand brought forward to avoid the announced import tariffs had a reversal effect in the second quarter.

The frontloading effects make it difficult to monitor the industrial economy. This is reflected more clearly in the business surveys, as companies usually ignore special effects when responding. According to the WIFO-Konjunkturtest (business cycle survey), the situation assessments of Austrian manufacturing companies have tended to brighten since the last low at the end of 2024, continuing in August 2025. However, the increase is relatively restrained and so far too weak to indicate an upswing. Likewise, the index of business expectations does not indicate a sustained upturn, currently.

The situation in the construction industry remains difficult. Although companies have reported a slight improvement since the beginning of 2025, there was a decline in construction value added in the first two quarters.

The economy has developed differently in the individual euro area countries so far this year. In Germany, economic output contracted after a strong start to the year (first quarter +0.3 percent, second quarter ‑0.3 percent). The same applies to Italy, although the setback there was less severe at ‑0.1 percent (first quarter +0.3 percent). By contrast, Spain and France were able to exceed the previous quarter's growth in the second quarter.

In China, the growth of real GDP slowed again in the second quarter of 2025 (+1.1 percent after +1.2 percent), while the USA increased its GDP strongly again.

The inflation rate in Austria rebounded significantly at the start of the year and subsequently remained at just over 3 percent. Inflation accelerated to 3.7 percent in July and even to 4.1 percent in August according to preliminary calculations by Statistics Austria (HICP). As a result, the inflation gap to the euro area average widened again considerably to 2 percentage points.

Due to the persistent economic weakness, the number of employees has largely stagnated for some time, while unemployment is on the rise. However, the increase appears to have slowed somewhat in July and August, which may be due to some stabilisation of the business cycle.