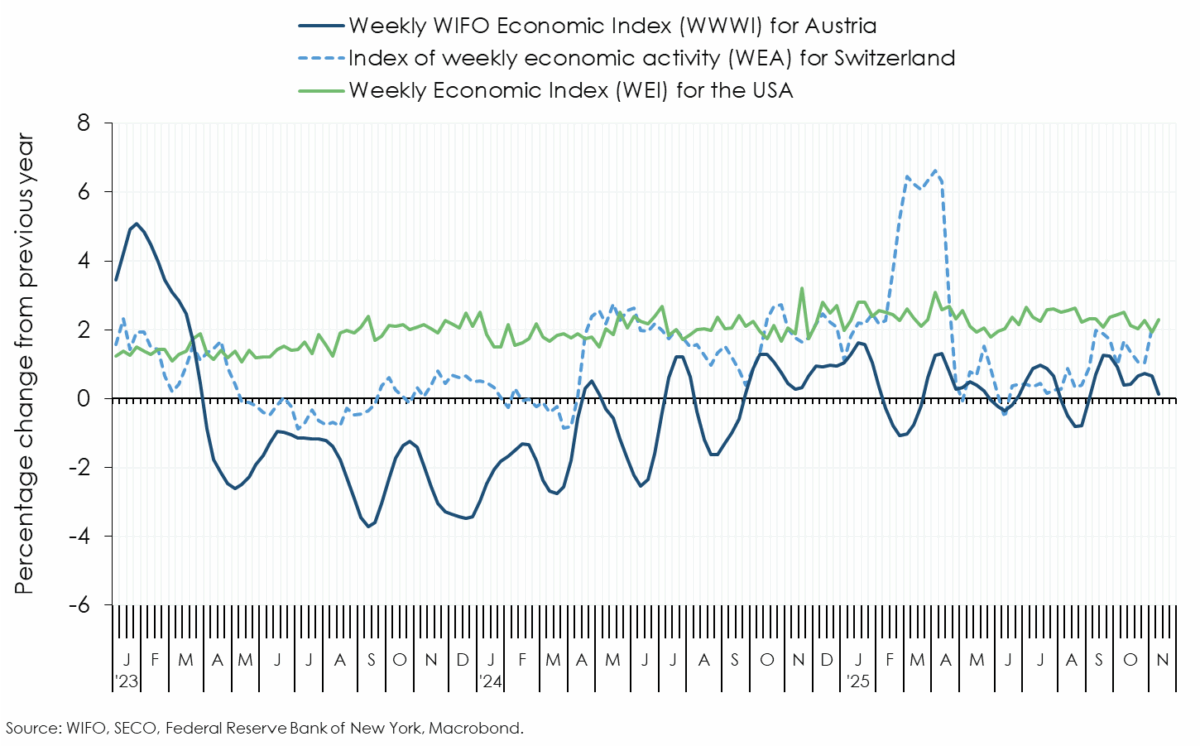

Weekly WIFO Economic Index

WWWI for GDP and its subcomponents

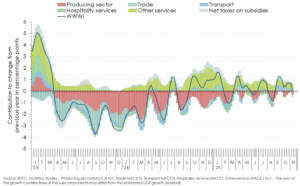

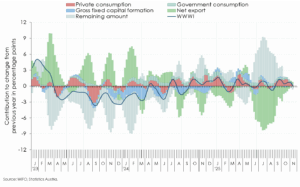

Based on the weekly indicator for GDP (WWWI), unadjusted domestic economic output rose by ½ percent year‑on‑year in October (calendar weeks 40 to 44) and in early November (calendar weeks 45 and 46; September +¾ percent, revised)1.

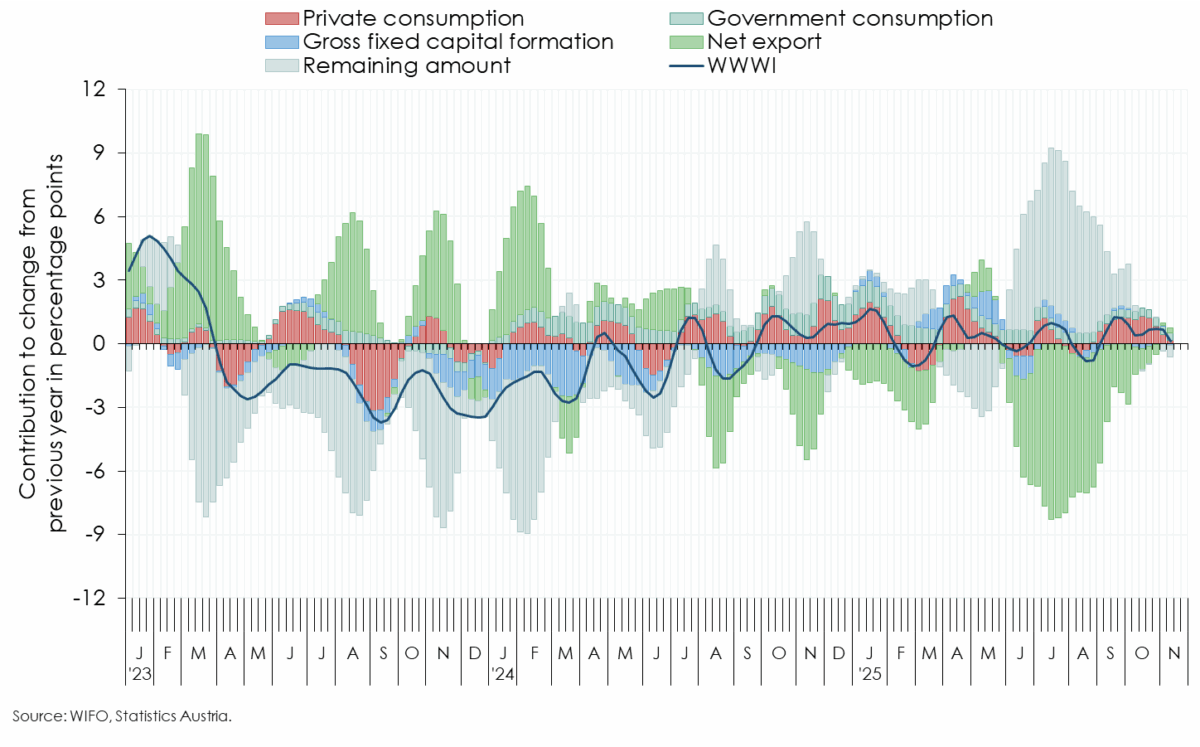

The inflation-adjusted volume of cashless transactions, serving as an indicator of household consumption expenditure, showed an increase in October and early November compared with the previous year. In October, the increase in demand is likely to have been stronger for services than for goods (retail sales). Private consumption grew by 2¼ percent in October and by ½ percent in the first two weeks of November compared with the same period last year (September +2 percent).

Gross fixed capital formation is driven by estimated output (industrial production) and by sentiment in manufacturing from the WIFO-Konjunkturtest (business cycle survey). In October, investment is likely to have fallen by ½ percent compared with the previous year (September 0 percent).

Based on developments in industrial production and tourism, as well as major demand components and the resulting effects on foreign trade, net exports in the broad sense made a negative contribution of 1¼ percentage points to GDP growth in October (September –3¼ percentage points).

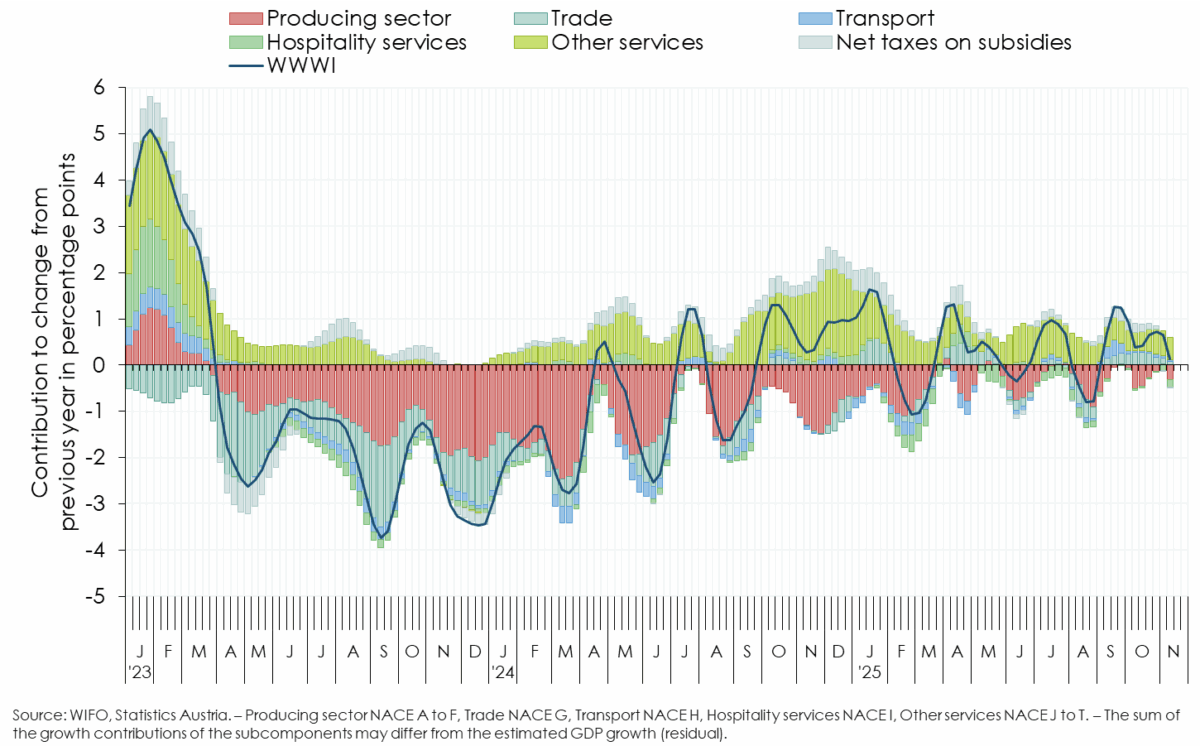

Truck mileage on Austria's motorways and passenger numbers at Vienna Airport rose year-on-year in October, while air freight handled at Vienna Airport and rail freight volumes declined overall. According to the WIFO-Konjunkturtest, companies in the transport sector have been taking a more negative view of the current business situation since August. Based on these indicators, value added in the transport sector (NACE 2008, section H) is expected to have increased by 1 percent year-on-year in October (September +4½ percent).

Employment in the goods-producing sector (NACE 2008, sections A to E) continued to fall amid the recession. The year-on-year increase in unemployed, which showed double digit rates between November 2023 and June 2025, has been single digit since July. The WIFO-Konjunkturtest shows that the current assessments of the situation remain predominantly pessimistic, although they have improved since the beginning of the year. WIFO estimates value added in the goods-producing sector was 1 percent lower in October than in the same period last year (first half of November and September –½% in each case).

Sentiment among construction companies is slowly brightening – both their assessment of the current situation and their expectations have already turned (slightly) positive. The number of registered unemployed in construction rose again in October. Employment continued to fall. Value added in construction (NACE 2008, section F) is estimated to have been 1¼ percent lower year‑on‑year in October (first half of November –½ percent, September –2¼ percent).

Based on cashless transactions in restaurants and hotels and sentiment indicators from the WIFO-Konjunkturtest, value added in tourism (accommodation and food services, NACE 2008, section I) is estimated ¾ percent lower in October compared to the previous year (September –1 percent). In trade (NACE 2008, section G), value added is expected to have risen by 2½ percent in October, with one more Saturday trading day than in 2024, and by 1 percent in the first two weeks of November (September +1½ percent).

Based on the current employment situation and the sentiment indicators from the WIFO-Konjunkturtest, value added in remaining market-related services (NACE 2008, sections J to N) is estimated to have increased by 1 percent year-on-year in September, October and early November. Value added in other personal services (NACE 2008, sections R to T), based on employment trends and company expectations from the WIFO-Konjunkturtest, is estimated to have been ½ percent lower in October than a year earlier (September –2¼ percent).

1 The inclusion of newly published and revised monthly data, which must be taken into account when estimating the WWWI, led to a revision of the WWWI for GDP. Notable supply-side WWWI revisions occurred particularly in the goods-producing sector (NACE 2008, sections A to E), remaining market-related services (sections J to N), accommodation and food services (section I) and trade (section G).

Weekly Economic Activity, WWWI – Production, WWWI – DemandThe WWWI is under constant development; it is regularly reviewed and will be expanded with new and additional weekly data series as they become available. The WWWI is not an official quarterly estimate, forecast or similar of WIFO.

The WIFO Weekly Economic Index (WWWI) is a measure of the real economic activity of the Austrian economy on a weekly and monthly frequency. It is based on weekly, monthly and quarterly time series to estimate weekly and monthly indicators for real GDP and 18 GDP sub-aggregates (use side 8, production side 10) of the Quarterly National Accounts.

With the release for June 2022, the econometric models for the historical decompositions and for nowcasting have been converted to seasonally unadjusted time series. In addition, year-on-year growth rates are now used to estimate the models.

The WWWI estimates are (currently) updated monthly and published on the WIFO website.