Kai Hüschelrath at WIFO Extern

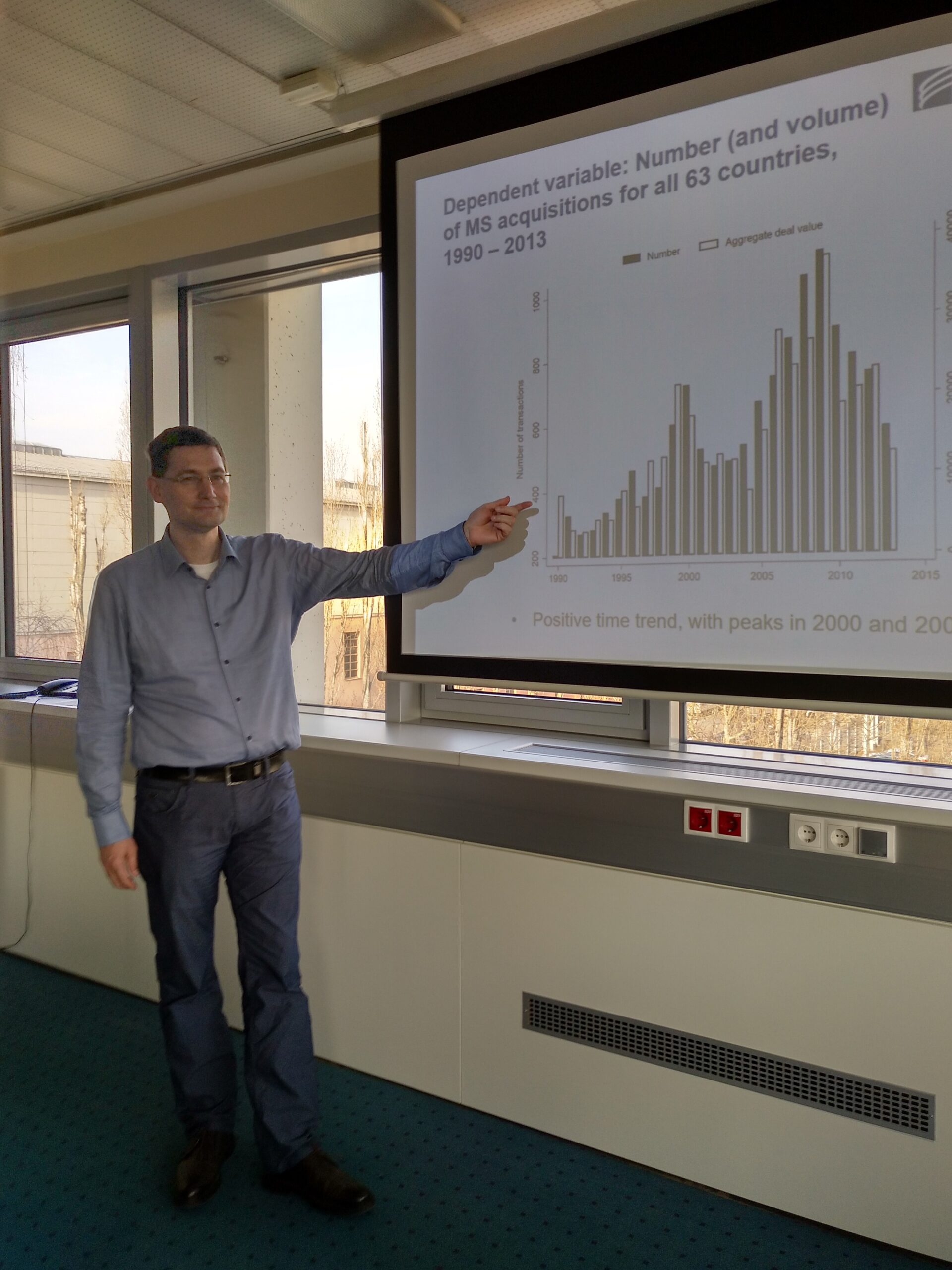

Kai Hüschelrath presented a study co-authored with Sven Heim, Ulrich Laitenberger and Yossi Spiegel which uses the introduction of national leniency programmes that destabilises collusive agreements and studies their effect on minority share acquisition. Using data from 63 countries, a large and significant increase in horizontal minority shareholding acquisitions in the year in which a leniency programme is introduced could be found, but only in countries with effective antitrust enforcement and low levels of corruption. For cross-border or non-horizontal minority shareholding acquisitions a similar effect could not be identified. The findings according to Hüschelrath suggest that firms use minority shareholding acquisitions to stabilise collusive agreements.

In his commentary, WIFO consultant Philipp Schmidt-Dengler, professor at the University of Vienna, pointed out the very convincing empirical evidence that minority shareholding acquisitions are indeed used strategically to compensate for the destabilising effect of leniency programmes. The work of Hüschelrath and co-authors according to Schmidt-Dengler suggests that antitrust authorities should monitor minority shareholdings more closely in the future, hereby not only focusing on minority shareholding acquisitions, but also on changes in the portfolio of minority shareholdings. The behaviour of firms in sales markets following minority shareholding acquisitions induced by leniency programmes could allow to distinguish horizontal from collusive effects.

Please contact