Christmas Business in Retail Trade in 2025 Slightly Above Previous Year's Level

WIFO forecasts that net turnover in the non-food retail trade will rise by 1.9 percent in value terms in December 2025, which is an increase of 0.6 percent in volume terms (adjusted for prices). For December an increase of turnover in food retail trade of around 4½ percent is forecasted. With an expected price increase of just over 3½ percent, the volume of turnover will only rise moderately (+0.8 percent) compared with the previous year.

Overall, for the retail trade (excluding motor vehicles motorcycles and fuel), growth of 3 percent in value terms is forecasted for December, with price-adjusted growth of +0.7 percent. According to preliminary estimates, this will result in an increase of 3.2 percent (value) and 1.0 percent (volume) for 2025.

In December, the value of turnover is higher than in other months for most retail sectors. For many sectors, a high December turnover is crucial for the annual balance sheet. Overall, retail trade (excluding motor vehicles, motorcycles and fuel) generated almost a fifth more turnover in December 2024 than in the rest of the year. For individual non-food sectors, these peaks in turnover were in some cases significantly higher. For example, turnover in retail sales of games and toys achieved almost three times the turnover in an average month, while turnover in retail sales with watches and jewellery as well as books almost doubled. The additional turnover in December contributed slightly less, but still between a quarter and a third more than usual, to the following retail sectors: audio and video equipment, sporting equipment, textiles, telecommunications equipment, cosmetic and toilet article, furniture and household articles. Turnover in retail sale of clothing and footwear, the increase is around one-fifth. After a sharp rise in the COVID-19 pandemic years (with an average rate of just under 30 percent in 2020-21), additional turnover in retail sales via mail order houses or via internet has levelled off at below 10 percent.

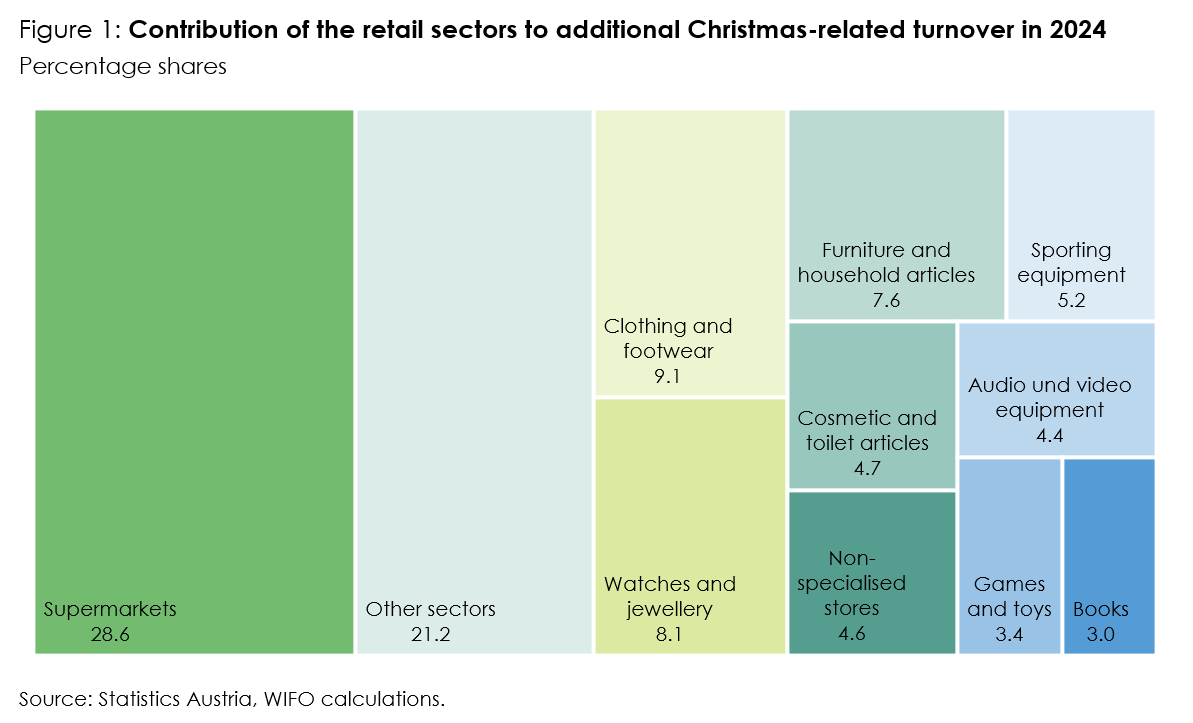

Besides the relevance of the additional turnover for the individual retail sectors, it is also interesting to analyse the contribution of each sector to the overall result of the "Christmas-related" additional turnover. Based on the calculated additional turnover of 1,164 million € for retail trade (excluding motor vehicles, motorcycles and fuels), around 29 percent come from retail sales in supermarkets (Figure 1). In the non-food sector, clothing and footwear (9 percent), watches and jewellery (8 precent) and furniture and household articles (8 percent) as well as sporting equipment (5 percent) make a significant contribution. Retail sales of games and toys are also still in the top ranks with just over 3 percent due to the high importance of December sales. Like many other sectors, retail sales via mail order houses or via internet only contribute to a limited extent to additional sales in December.

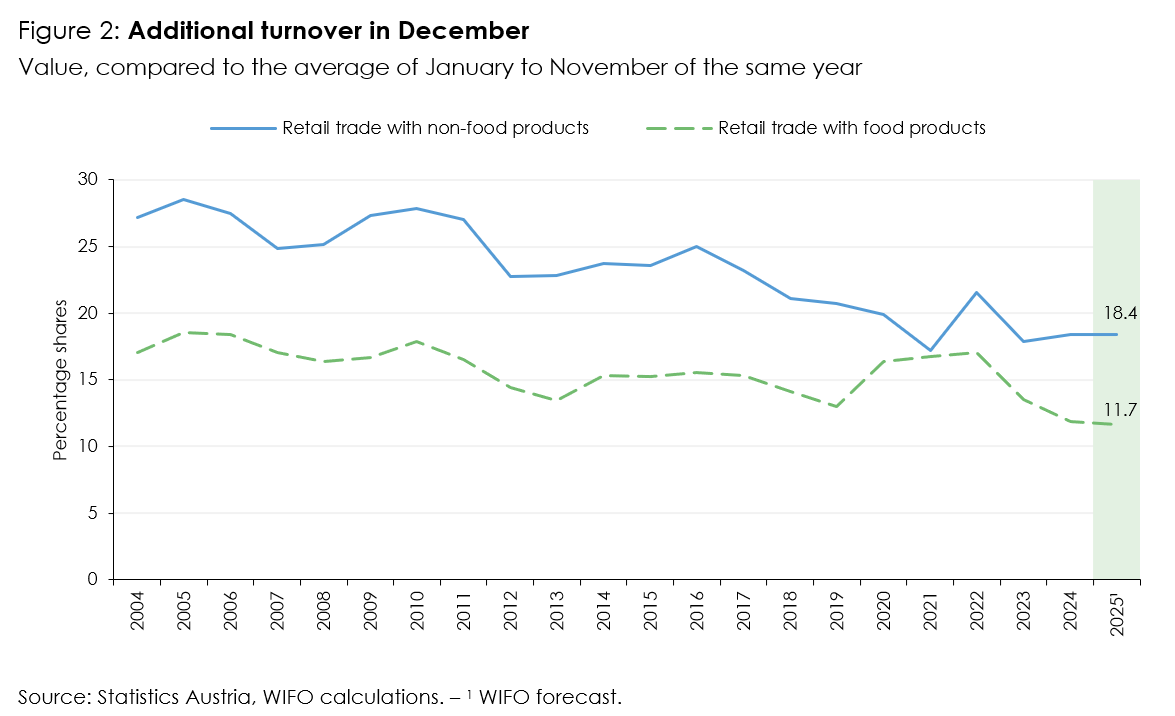

Even though the December peaks are very important for the retail trade (excluding motor vehicles, motorcycles and fuels), as they are for many retail sectors, they are steadily declining in a long-term comparison. There are many reasons for this downward trend. Changes in consumer behaviour in the run-up to Christmas, such as increased use of November promotion days or weeks around Black Friday, are leading to a shift in turnover to November. Another aspect is the trend towards cash gifts and vouchers, which leads to a shift in sales to January, as sales can only be recognised when the vouchers are redeemed. A decline in the importance of Christmas can also be observed. General consumer behaviour has also changed over time. Households are spending more on services (e.g., holidays, leisure activities, eating out). With a "constant" household budget, this is at the expense of spending on goods in brick-and-mortar retailers. The steady increase in online retail and the dominance of large foreign platforms (such as Amazon and Zalando), coupled with an increasing number of new international sales platforms (such as Temu and Shein), are further fuelling the general trend of falling additional turnover in domestic retail trade.

An analysis of this additional turnover in the period from 2004 to 2025 illustrates this development (Figure 2). While the value of additional turnover in the non-food sector averaged around a quarter between 2004 and 2017, it has fallen further to below 18 percent by 2023. Only in the last two years has the share increased slightly again. In the food sector, this trend is less pronounced, with additional turnover fluctuating around 16 percent since 2004. After a temporary increase during the COVID-19 crisis years, they are currently below 12 percent.

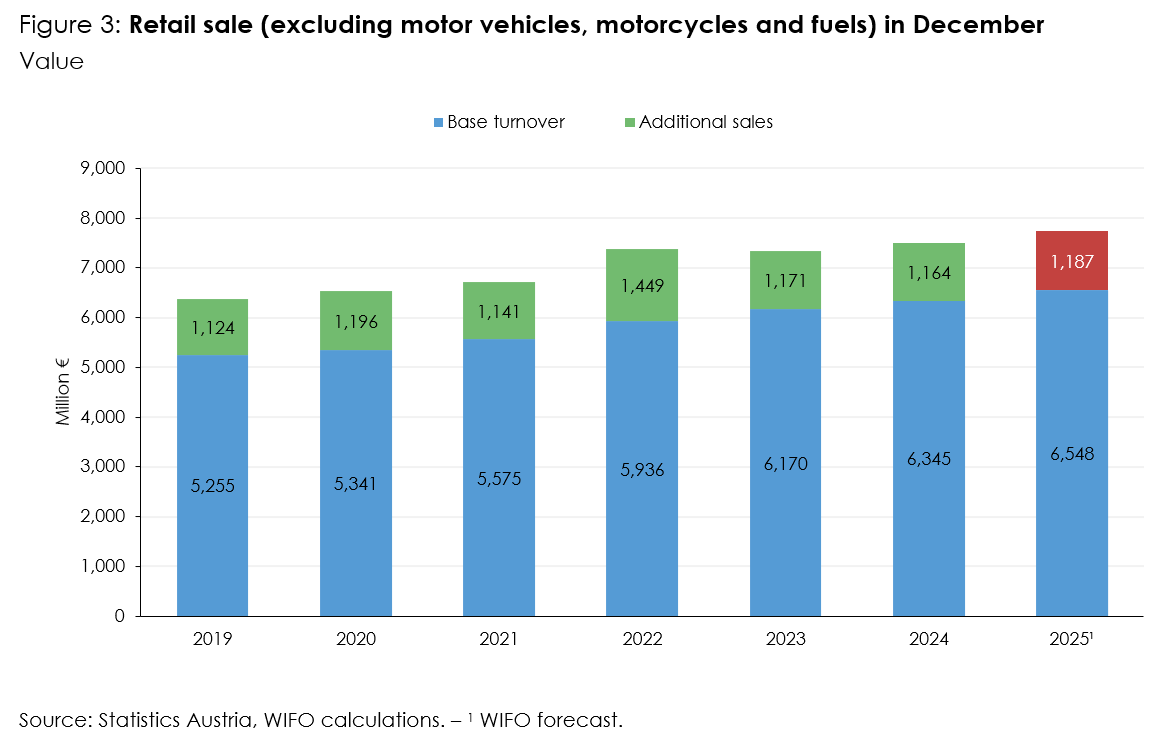

WIFO calculates that this year's Christmas sales will generate additional turnover of 1.19 billion € (value) compared to the average for January to November (Figure 3). According to preliminary calculations, this is slightly above the previous year's figure (2024: 1.16 billion €). Of this additional turnover, around 65 percent are attributable to the non-food retail trade and 35 percent to the food retail trade.

When looking at the additional Christmas-related turnover, taking into account the months of November (keyword: shift in sales to November due to Black Friday) and January of the following year (keyword: sales generated by voucher redemptions), preliminary calculations show that the corresponding additional turnover in these three months – compared to the average from February to October – will be slightly higher in the non-food retail trade than in 2024. In the food retail trade, however, additional sales will decline.

Methodological note and data basis

WIFO defines Christmas sales in the retail trade (excluding motor vehicles, motorcycles and fuels) as those additional sales in December that exceed a certain "normal level". The average sales trend from January to November is used as a benchmark. Calendar-related effects (such as the number of sales days or their distribution) are also included in the estimate on a weighted basis. Economic developments, external conditions and changes in consumer behaviour are also taken into account.

The turnover indices of retail trade from Statistics Austria's short-term business statistics are available as a data basis. These represent the development of net domestic sales of companies subject to VAT.