Brightening of the Manufacturing Sector Amid Persistently High Uncertainty

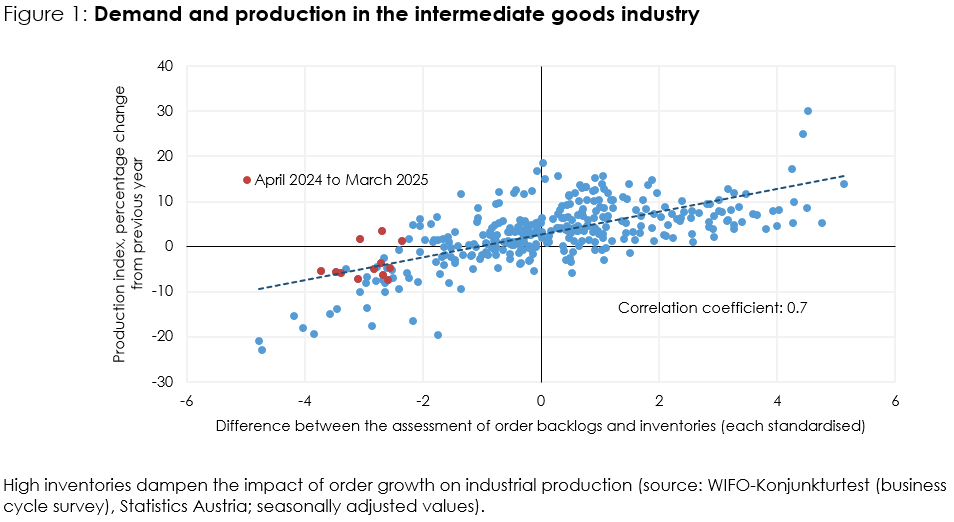

"The current high stock levels are enabling industrial companies to fulfil new orders by reducing inventories rather than increasing production", says Christian Glocker, author of the latest WIFO Business Cycle Report.

According to Statistics Austria, Austria's gross domestic product grew by 0.1 percent in the first quarter of 2025 compared to the previous quarter, after stagnating in the fourth quarter of 2024. Although there is still a decline compared to the same quarter of the previous year, it is now lower than assumed in May (–0.4 percent instead of –0.7 percent, seasonally and working day adjusted) due to extensive data revisions in the Quarterly National Accounts for 2024.

On the supply side, the positive contribution from the secondary sector stood out in the first quarter of 2025. However, the increase in value added in manufacturing (+1.0 percent compared to the previous quarter) was offset by a decline in construction value added (‑0.3 percent). Despite the expansion in public administration in the broad sense (NACE 2008, sections O to Q +0.7 percent), the tertiary sector made no contribution to growth in the spring, as value added in accommodation and food service activities (–2.6 percent) and transportation (–1.7 percent) shrank. On the demand side, public consumer spending increased strongly by +2.3 percent, while gross capital formation declined (–1.3 percent). At +0.6 percentage points, foreign trade contributed the most to the slight growth of the total economy in purely arithmetical terms. On the income side, the rise in wage income was accompanied by a decline in capital income.

The leading indicators continue to paint a mixed picture. They have recently deteriorated in market-related services; this applies in particular to business expectations in the accommodation and food service activities sector. In contrast, the leading indicators for the manufacturing sector show a brightening of sentiment. However, the underlying survey data does not yet take into account the latest tariff threats from the USA. Consumers remained pessimistic, especially when looking ahead. Consumer confidence remained at a low level. However, the indicator for the subjectively perceived risk of job losses improved recently.

Price pressure remains pronounced. In April 2025, the harmonised consumer price index (HICP) was 3.3 percent above the previous year's level. This means that inflation in Austria remained more buoyant than the euro area average. In May, inflation according to the CPI is likely to have slowed only slightly to 3.0 percent (according to Statistics Austria's flash estimate; April 3.1 percent). The GDP deflator as a measure of the price pressure of domestically produced goods and services rose again in the first quarter (+2.1 percent compared to the first quarter of 2024), although the increase was slightly weaker than the average for the previous year.

The economic slowdown is weighing on the labour market. According to the National Accounts, the number of people in employment fell slightly in the first quarter of 2025 compared to the previous quarter, while the volume of labour shrank more significantly at –1.1 percent. The rise in unemployment and the decline in job vacancies continued. According to preliminary estimates, the number of persons in active dependent employment in May 2025 was 4,000 (+0.1 percent) higher than in the previous year, compared to around +3,500 in April. At the end of May, around 23,000 more persons were registered as unemployed than a year ago (+8.5 percent); in addition, there were around 1,100 more persons in AMS training (+1.3 percent). The unemployment rate (national definition) is expected to be 6.9 percent (0.5 percentage points above the previous year).