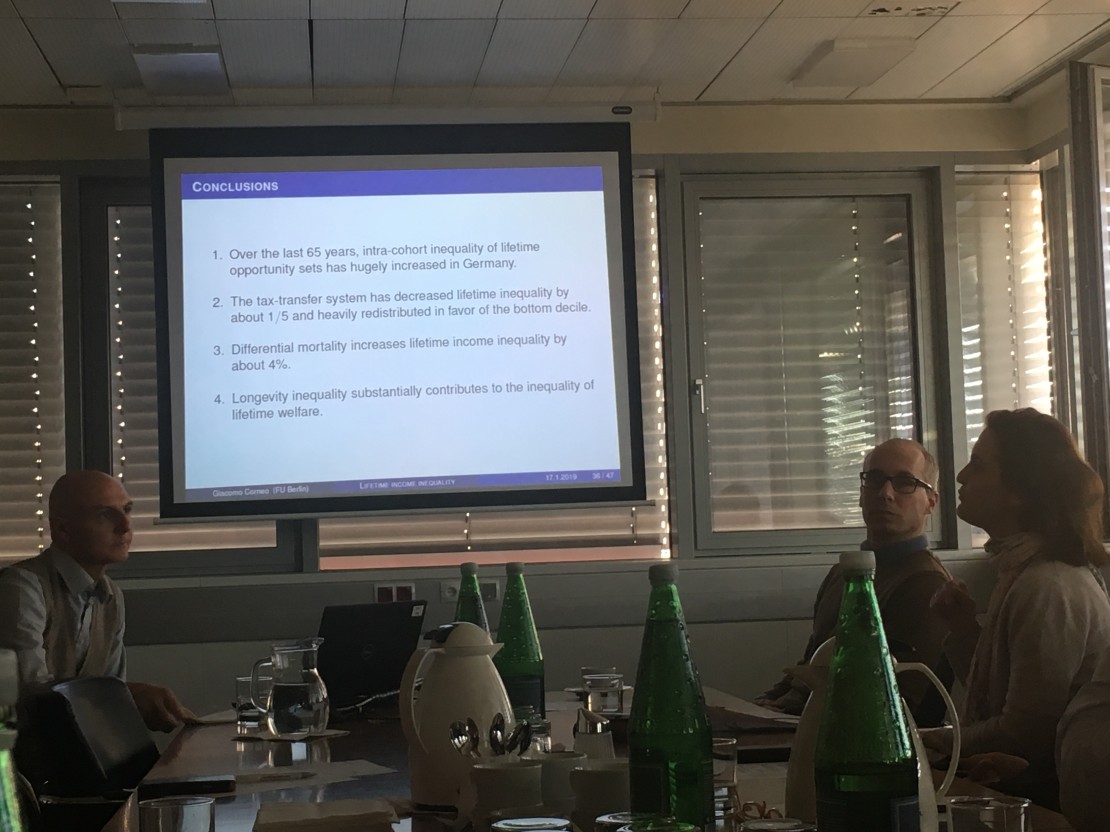

Giacomo Corneo's analysis, undertaken together with Timm Bönke and Holger Lüthen (both researchers at Free University Berlin), shows a marked secular increase in income inequality over the life course, both before and after redistribution. Over the entire life course, the German tax transfer system is progressive and has a significant impact on the disposable income of the two extreme deciles of life income distribution. The redistribution of life income shows an inverted U-form across cohorts and is significantly smaller than on an annual basis. Differential mortality increases income inequality over the life course by about 5 percent. A welfare measure developed by the FU researchers that takes into account the monetary value of a longer life span shows that different mortality rates increase inequality in welfare over the life course measured in monetary units by about 13 percent.

WIFO distribution researcher Silvia Rocha-Akis underlined the importance of this analysis. In the public discussion there

is often talk of the stagnating escalator, which has guaranteed for decades that the standard of living will rise in comparison

to the parent generation. The comparison of the distribution of income from gainful employment between different generations

allows a new perspective on this topic. The costs of adapting to technological and social change and to global competition

were apparently borne primarily by younger people with low formal qualifications. The inequality that has increased over generations

is also evident after taking into account taxes and transfers. However, the redistribution within households as well as the

redistribution between households is relevant for a comprehensive understanding of redistribution, since the sharing or giving

of income, savings and assets between parents, adult children and grandchildren may have gained in importance over time. In

addition, public benefits in kind (in Austria) not included in the analysis contribute most to redistribution.

Zum Buch von Giacomo Corneo "Is Capitalism Obselete?"